Tag: CGA

Checkpoints to be observed before the submission of March (Pre.) and March Sy-I to O/o CGA: Finmin, CGA O.M dated 03.03.2026

Checkpoints to be observed before the submission of March (Pre.) and March Sy-I to O/o CGA: Finmin, CGA O.M dated 03.03.2026

P-23001/1/2021-DAMA-CGA/ ...

Review of issue of C category cheque from government payment – Compliance of Subsidiary Instruction to CGA(R&P) Rule 2022 and CAM 2024

Review of issue of C category cheque from government payment - Compliance of Subsidiary Instruction to CGA(R&P) Rule 2022 and CAM 2024

F. No. TA- ...

Mandatory Course Completion & Comprehensive Assessment on the iGoT Karmayogi Protal: CGA OM

Mandatory Course Completion & Comprehensive Assessment on the iGoT Karmayogi Protal: CGA OM

E-16420/ A-33025/6/2024-Group B-CGA/657

Government o ...

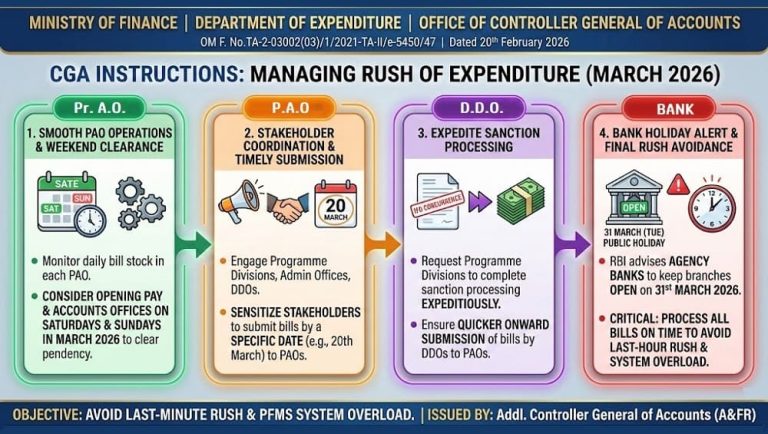

Rush of expenditure in March, 2026 – Opening of Pay and Accounts Office on Saturdays and Sundays falling in March 2026: CGA OM

Rush of expenditure in March, 2026 – Opening of Pay and Accounts Office on Saturdays and Sundays falling in March 2026 to clear the pendency of bills ...

Accounting Procedure for Central Government Employees Group Insurance Scheme, 1980 – Master Circular by CGA

Accounting Procedure for Central Government Employees Group Insurance Scheme, 1980 – Master Circular by CGA, FinMin dated 17.02.206

No. 9(3)/2024/TA/ ...

Opening of Agency Banks on March 31, 2026 (Public Holiday on account of Mahavir Janmakalyanak): CGA O.M. dated 12.02.2026

Opening of Agency Banks on March 31, 2026 (Public Holiday on account of Mahavir Janmakalyanak): CGA O.M. dated 12.02.2026

Ministry of Finance

Depart ...

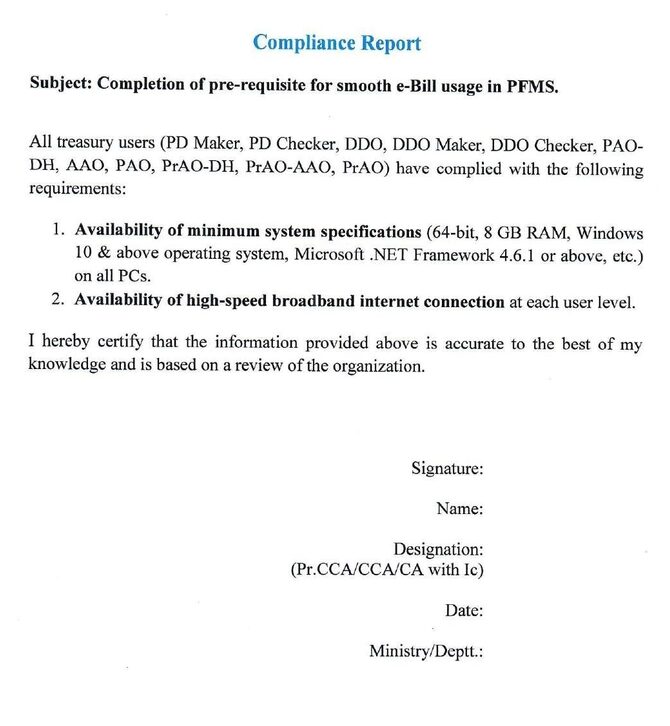

Compliance of completion of pre-requisites for smooth e-bill usage in PFMS – CGA Office Memorandum dated 12.01.2026

Compliance of completion of pre-requisites for smooth e-bill usage in PFMS – CGA Office Memorandum dated 12.01.2026

No. M-54014/1/2025-CGA/ CF. No 18 ...

Creation of Centralized cadres for Central Expenditure Audit and Central Revenue Audit: CAG Circular No. 43 – Staff Wing/2025 dated 21.11.2025

Creation of Centralized cadres for Central Expenditure Audit and Central Revenue Audit: CAG Circular No. 43 - Staff Wing/2025 dated 21.11.2025

Circ ...

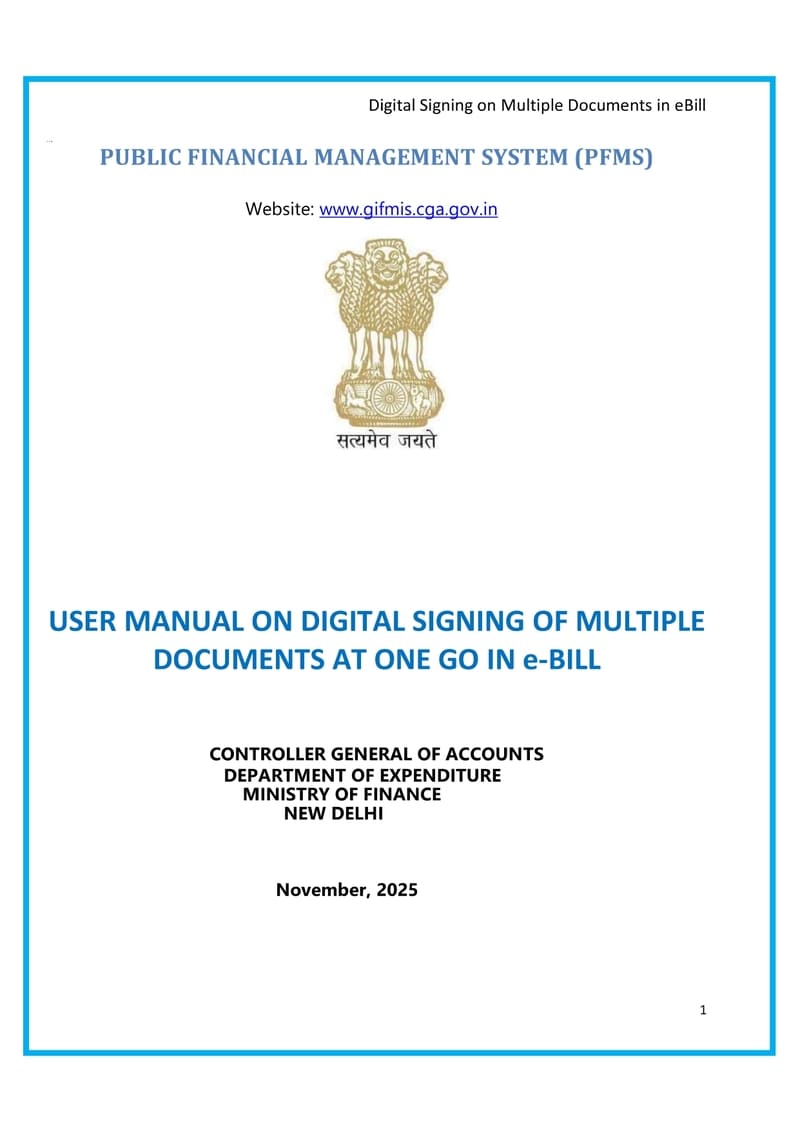

New feature of Digital signing of Multiple Documents at one go in e-bill scenario in PFMS/GIFMIS: CGA OM dated 11.11.2025

New feature of Digital signing of Multiple Documents at one go in e-bill scenario in PFMS/GIFMIS: CGA OM dated 11.11.2025

File No. I-12024/2/2023-CGA ...

Maintenance of registers by PAOs/CDDOs as prescribed in Civil Accounts Manual, 2024 for accounting and reconciliation: CGA Order dated 07.11.2025

Maintenance of registers by PAOs/CDDOs as prescribed in Civil Accounts Manual, 2024 for accounting and reconciliation: CGA Order dated 07.11.2025

F. ...