Author: Rashmi Prasad

Fresh Empanelment of Smiling Ages Dental Clinic under CGHS Dehradun – CGHS OM dated 03.03.2026

Fresh Empanelment of Smiling Ages Dental Clinic under CGHS Dehradun - CGHS OM dated 03.03.2026

भारत सरकार

स्वास्थ्य एवं परिवार कल्याण मंत्रालय

...

Constitution of Review Committees for the purpose of reviewing suspension cases in Employees Provident Fund Organisation reg.

Constitution of Review Committees for the purpose of reviewing suspension cases in Employees Provident Fund Organisation reg.

Employees Provident Fun ...

Revised rates of Industrial Dearness Allowance (IDA) Rates for Executives and Non-Unionized Supervisors of CPSEs with effect from 01.01.2026: DPE OM

Revised rates of Industrial Dearness Allowance (IDA) Rates for Executives and Non-Unionized Supervisors of CPSEs with effect from 01.01.2026: DPE OM

...

Checkpoints to be observed before the submission of March (Pre.) and March Sy-I to O/o CGA: Finmin, CGA O.M dated 03.03.2026

Checkpoints to be observed before the submission of March (Pre.) and March Sy-I to O/o CGA: Finmin, CGA O.M dated 03.03.2026

P-23001/1/2021-DAMA-CGA/ ...

Review of issue of C category cheque from government payment – Compliance of Subsidiary Instruction to CGA(R&P) Rule 2022 and CAM 2024

Review of issue of C category cheque from government payment - Compliance of Subsidiary Instruction to CGA(R&P) Rule 2022 and CAM 2024

F. No. TA- ...

Format-1 of Railway Services (Pension) Rules, 2026 – Railway Board RBE No.18/2026

Format-1 of Railway Services (Pension) Rules, 2026 - Railway Board RBE No.18/2026

RBE No. 18 /2026.

GOVERNMENT OF INDIA (BHARAT SARKAR)

MINISTRY OF ...

Revised dated for Group ‘B’ 30% LDCE Centralized CBT on 12.04.2026 and 19.04.2026: Railway Board order dated 26.02.2026

Revised dated for Group ‘B’ 30% LDCE Centralized CBT on 12.04.2026 and 19.04.2026: Railway Board order dated 26.02.2026

GOVERNMENT OF INDIA

MINISTRY ...

केंद्रीय कर्मचारियों और पेंशनरों की बड़ी मांग: 50% महंगाई भत्ता बेसिक पे में मर्ज करो, तुरंत अंतरिम राहत दो! FNPO ने 8वीं वेतन आयोग को सौंपा पत्र

केंद्रीय कर्मचारियों और पेंशनरों की बड़ी मांग: 50% महंगाई भत्ता बेसिक पे में मर्ज करो, तुरंत अंतरिम राहत दो! FNPO ने 8वीं वेतन आयोग को सौंपा पत्र

महं ...

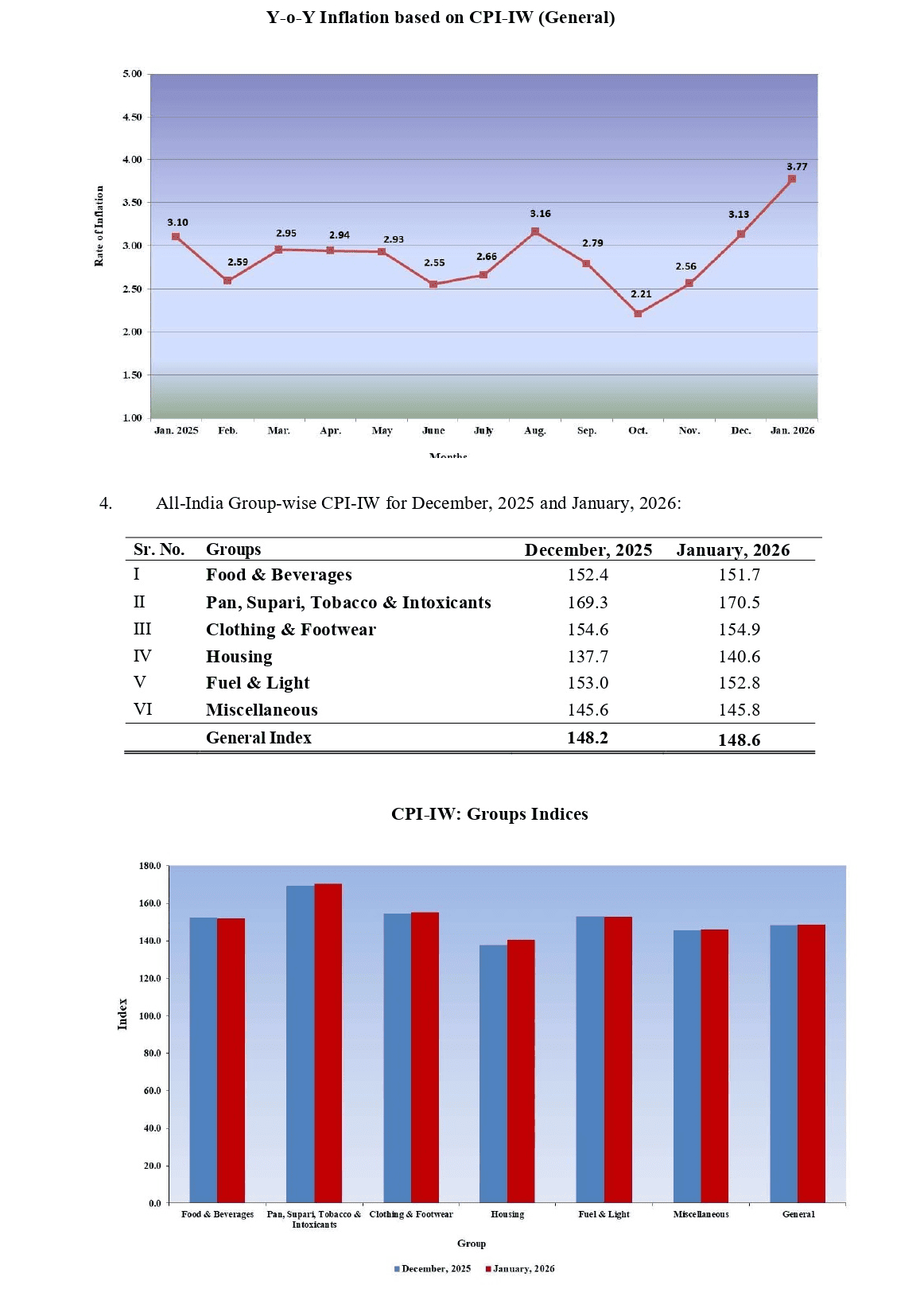

Consumer Price Index for Industrial Workers (2016=100) — January, 2026: Labour Bureau Press Release dated 27.02.2026

Consumer Price Index for Industrial Workers (2016=100) — January, 2026: Labour Bureau Press Release dated 27.02.2026

GOVERNMENT OF INDIA

MINISTRY OF ...

Mandatory Course Completion & Comprehensive Assessment on the iGoT Karmayogi Protal: CGA OM

Mandatory Course Completion & Comprehensive Assessment on the iGoT Karmayogi Protal: CGA OM

E-16420/ A-33025/6/2024-Group B-CGA/657

Government o ...