Tag: Income Tax

Message on revising Income Tax Returns: Whether I.T. Department have requested the tax payers to revise their returns – Rajyasabha Question No.1181

Message on revising Income Tax Returns: Whether I.T. Department have requested the tax payers to revise their returns - Rajyasabha Question No.1181

G ...

New Income Tax Act – Simplified Income Tax Rules: Budget 2026-2027 Highlights

New Income Tax Act - Simplified Income Tax Rules: Budget 2026-2027 Highlights

Direct Taxes: New Income Tax Act

New Income tax Act ,2025 to come ...

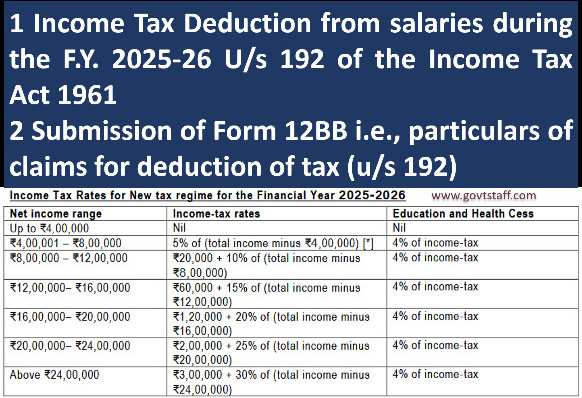

Income Tax Deduction from salaries during the F.Y. 2025-26 and submission o form 12BB reg – CPCB Circular dated 18.11.2025

Income Tax Deduction from salaries during the F.Y. 2025-26 and submission o form 12BB reg - CPCB Circular dated 18.11.2025

केंद्रीय प्रदूषण नियंत्र ...

Relaxation of time limit for processing of returns of income filed electronically which were incorrectly invalidated by CPC: Income Tax Circular No. 10/2025

Relaxation of time limit for processing of returns of income filed electronically which were incorrectly invalidated by CPC: Income Tax Circular No. 1 ...

Income-tax Act, 2025 – BILL No. 24 OF 2025

Income-tax Act, 2025 – BILL No. 24 OF 2025

The Gazette of India

CG-DL-E-13022025-261003

EXTRAORDINARY

PART II — Section 2

PUBLISHED BY AUTHORITY

...

Union Budget 2025-26: FAQ on Income-Tax Benefits under New Regime

Union Budget 2025-26: FAQ on Income-Tax Benefits under New Regime

FAQ.1: Personal Income-tax reforms with special focus on middle class

Q.1. What is ...

Union Budget 2025-26: Rs. 12 Lakh Income Tax-Free, Standard Deduction Increased to Rs. 75,000 for Salaried Individuals/ 12 लाख रुपये तक की आय पर कोई आयकर नहीं, 75,000 रुपये की मानक कटौती

Union Budget 2025-26: Rs. 12 Lakh Income Tax-Free, Standard Deduction Increased to Rs. 75,000 for Salaried Individuals/ 12 लाख रुपये तक की आय पर ...

Benefits for Senior Citizens and Super Senior Citizens under Income Tax Act, 1961

Benefits for Senior Citizens and Super Senior Citizens under Income Tax Act, 1961

C/7099/I-Tax/SAPCS/2027

24 May 2024

एकीकृत मुख्यालय रक्षा मंत्रा ...

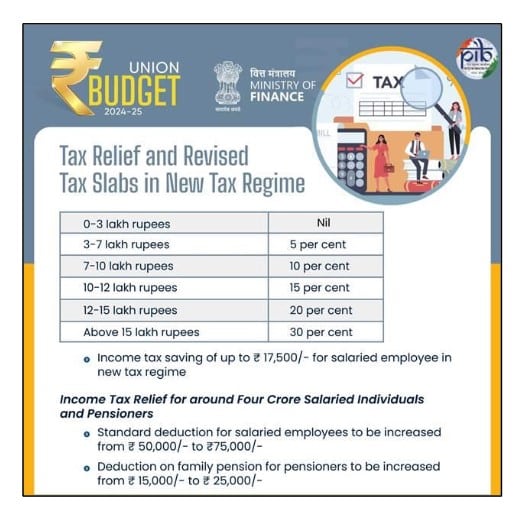

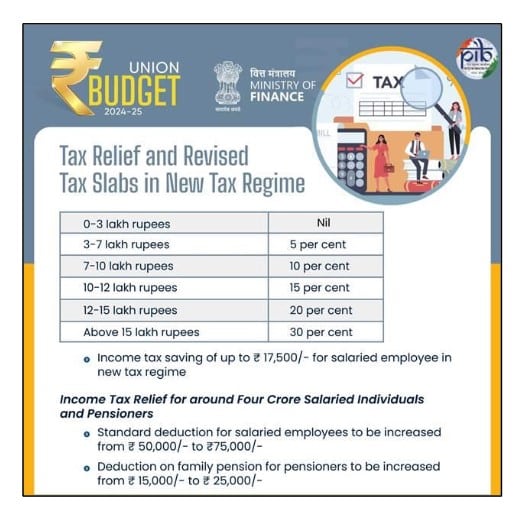

Tax Relief and Revised Tax Slabs in New Tax Regime – Standard deduction increased from 50,000 to 75,000

Tax Relief and Revised Tax Slabs in New Tax Regime – Standard deduction increased from 50,000 to 75,000

Ministry of Finance

GOVERNMENT MAKES NEW T ...

Income Tax 2024: Budget 2024-25 Introduces Enhanced Deductions and Revised Tax Slabs

Income Tax 2024: Budget 2024-25 Introduces Enhanced Deductions and Revised Tax Slabs

Celebrating Income Tax Day 2024 : A Journey of Transformation

B ...