Tag: NPS

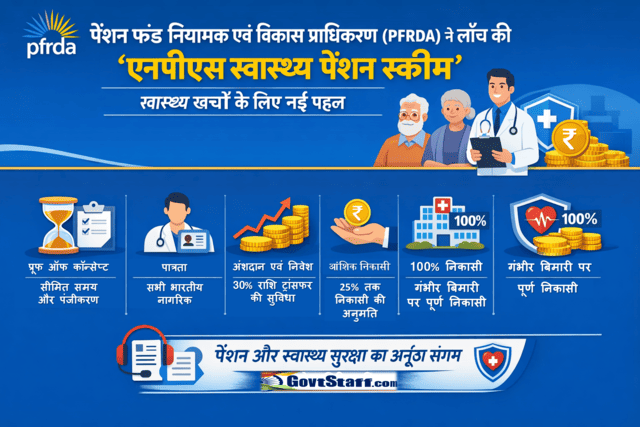

पेंशन फंड नियामक एवं विकास प्राधिकरण (PFRDA) ने लॉन्च की ‘एनपीएस स्वास्थ्य पेंशन स्कीम’ – स्वास्थ्य खर्चों के लिए नई पहल

पेंशन फंड नियामक एवं विकास प्राधिकरण (PFRDA) ने लॉन्च की ‘एनपीएस स्वास्थ्य पेंशन स्कीम’ – स्वास्थ्य खर्चों के लिए नई पहल

पेंशन फंड नियामक एवं विकास ...

PFRDA cautions investors against fraudulent website and mobile application viz xpo-ru / PFRDA ने xpo-ru नामक फर्जी वेबसाइट और मोबाइल एप्लिकेशन के प्रति निवेशकों को सावधान किया

PFRDA cautions investors against fraudulent website and mobile application viz xpo-ru / PFRDA ने xpo-ru नामक फर्जी वेबसाइट और मोबाइल एप्लिकेशन के प्रत ...

Security Guidelines to all PFMS users for strict adherance: CGA, PFMS (HQ) Office Memorandum dated 05.02.2026

Security Guidelines to all PFMS users for strict adherance: CGA, PFMS (HQ) Office Memorandum dated 05.02.2026

No. V-12025/5/2025-PFMS/C.N. 18742/56 ...

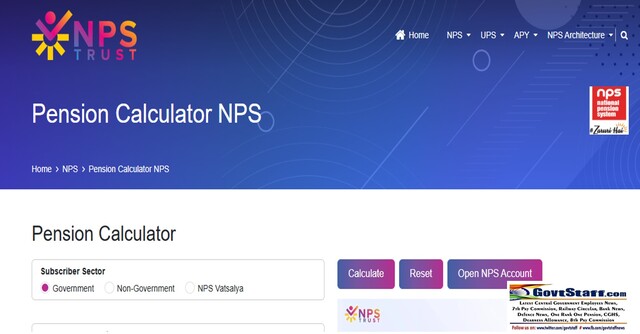

NPS Pension Calculator by NPS Trust – User Manual (v2.0)

NPS Pension Calculator by NPS Trust – User Manual (v2.0)

NPS Pension Calculator by NPS Trust to plan better. This manual explains how to use the NPS ...

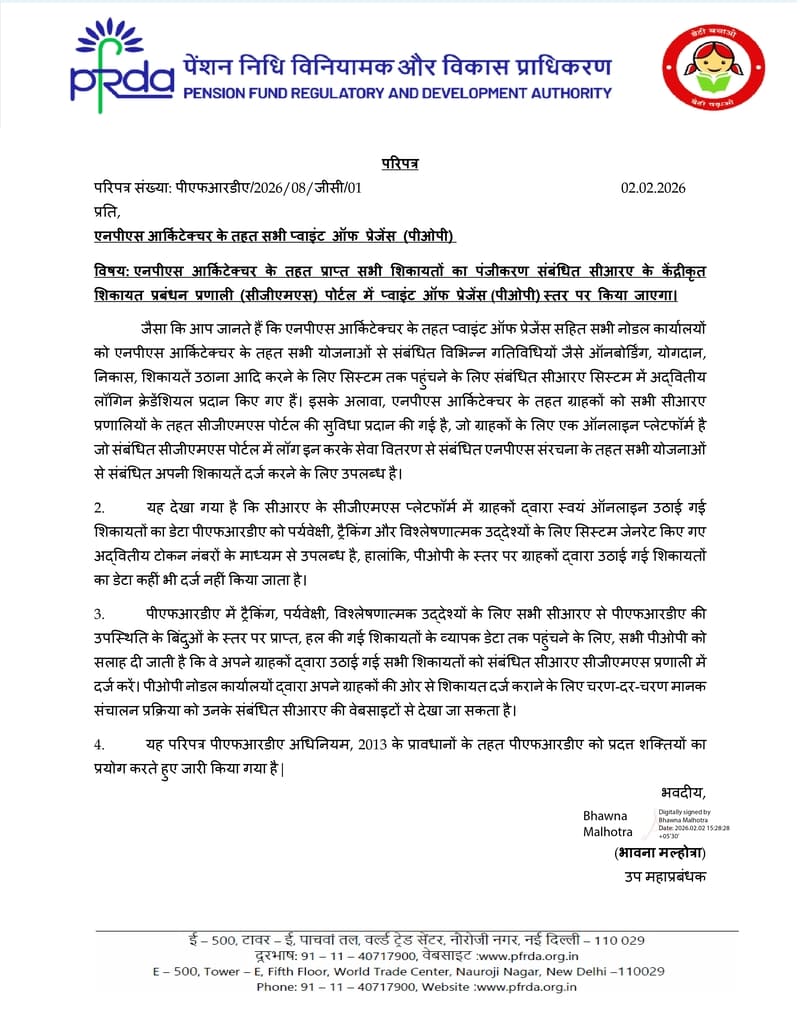

PFRDA circular on mandatory registration of grievances received under NPS Architecture raised at the level of Points of Presence (POP) in the respective CRA Centralized Grievance Management System (CGMS) portals

PFRDA circular on mandatory registration of grievances received under NPS Architecture raised at the level of Points of Presence (POP) in the respecti ...

Constitution of Committee for Strategic Asset Allocation and Risk Governance (SAARG): PFRDA Press Release

Constitution of Committee for Strategic Asset Allocation and Risk Governance (SAARG): PFRDA Press Release

पेंशन निधि विनियामक एवं विकास प्राधिकरण (PF ...

Accountal of interest payable/received on refund of employee’s share thereon under RSPR(1993) in the event of death of railway servant covered under NPS or his discharge on the ground of disablement or invalidation- ACS No.16 to Indian Railways Finance Code Vol-1

Accountal of interest payable/received on refund of employee’s share thereon under RSPR(1993) in the event of death of railway servant covered under N ...

Operational Guidelines on New Enrolment Incentive (NEI) under Multiple Scheme Framework (MSF) for Non-Government Sector under NPS

Operational Guidelines on New Enrolment Incentive (NEI) under Multiple Scheme Framework (MSF) for Non-Government Sector under NPS: PFRDA Circular date ...

NPS Vatsalya Scheme Guidelines 2025 to strengthen long-term financial security for Minors – PFRDA Press Release

NPS Vatsalya Scheme Guidelines 2025 to strengthen long-term financial security for Minors - PFRDA Press Release

Press Release

PFRDA issues NPS V ...

PFRDA Guidelines for Registration of Pension funds 2026

PFRDA Guidelines for Registration of Pension funds 2026

PENSION FUND REGULATORY AND DEVELOPMENT AUTHORITY (REGISTRATION OF PENSION FUNDS) GUIDELINE ...