Income Tax Deduction from salaries during the F.Y. 2025-26 and submission o form 12BB reg – CPCB Circular dated 18.11.2025

केंद्रीय प्रदूषण नियंत्रण बोर्ड, दिल्ली

(पर्यावरण वन एवं जलवायु परिवर्तन मंत्रालय, भारत सरकार के अंतर्गत एक स्वायत्त संस्था)

परिवेश-भवन, पूर्वी अर्जुन नगर, शाहदरा, दिल्ली -११००३२

मिसिल संख्या एसी-१०१/०५/वीजी/२०२5-२०२6/

18 नवंबर 2025

CIRCULAR/परिपत्र

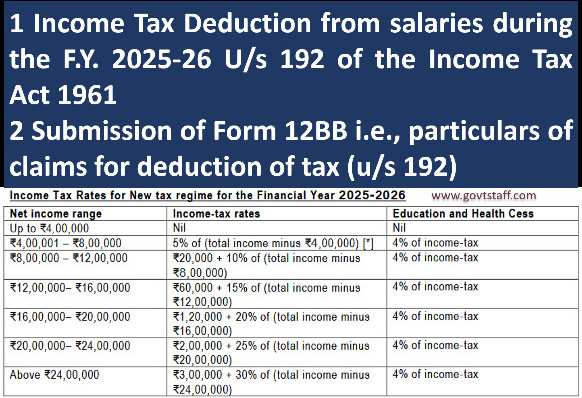

Subject: 1 Income Tax Deduction from salaries during the F.Y. 2025-26 U/s 192 of the Income Tax Act 1961

2 Submission of Form 12BB i.e., particulars of claims for deduction of tax (u/s 192)

As per the Finance Act, 2025, income-tax is mandatorily required to be deducted under Section 192 of the Act from Income chargeable under the head “Salaries” for the financial year 2025-2026 i.e., Assessment Year 2026-27.

2. The Budget 2020 had introduced a New Tax Regime under section 115BAC giving an option to individuals and HUF taxpayers to pay income tax at lower rates. The new system is applicable for income earned during the current Financial Year 2025-26 also, which relates to Assessment Year 2026-27. The new tax regime is available for individuals and HUFs with lower tax rates and zero deductions/exemptions.

3. This present Circular contains the rates of deduction of income-tax under old tax slabs and New tax regime from the payment of income chargeable under the head “Salaries” during the financial year 2025-2026 and explains certain related provisions of the Act and Income-tax Rules, 1962 (hereinafter the Rules).The relevant Acts, Rules, Forms and Notifications are available at the website of the Income Tax Department www.incometaxindia.gov.in.

4. Every person who is responsible for paying any income chargeable under the head “Salaries” shall deduct income-tax on the estimated income of the assesses under the head “Salaries” for the financial year 2025-2026. The income-tax is required to be calculated based on the rates given in this circular, subject to the provisions related to requirement to furnish PAN as per sec 206AA of the Act and shall be deducted at the time of each payment. No tax, however, will be required to be deducted at source in any case unless the estimated salary income including the value of perquisites, for the financial year exceeds ₹2,50,000/- or ₹3,00,000/- as the case may be, depending upon the age of the employee.

5. Permanent Account Number (PAN) linked with Aadhar Number of the assessee is mandatory. If not furnished, tax at source is to be deducted at the prescribed rates or 20% whichever is higher without giving any rebate/deduction.

6. Section 192(2बी) enables a taxpayer may furnish particulars of income under any head other than “Salaries” (not being a loss under any such head other than the loss under the head ― Income from house property) received by the taxpayer for the same financial year and of any tax deducted at source thereon. The particulars may be furnished in the enclosed Form of 12 BB along-with annexure, which is to be signed and verified by the taxpayer in the manner as prescribed under Rule 26B(2) of the Income Tax Rules.

7. DDO can consider loss under the head―Income from house property only. Loss under any other head cannot be considered by the DDO for calculating the amount of tax to be deducted. Also Tax on salaries cannot be reduced by the addition of TDS on Other Income.

8. If the jurisdictional TDS officer of the Taxpayer issues a certificate of No Deduction or Lower Deduction of Tax under section 197 of the Act, in response to the application filed before him in Form No 13 by the Taxpayer; then the DDO should consider such certificate and deduct tax on the salary payable at the rates mentioned therein. (Rule 28AA). The Unique Identification Number of the certificate is required to be reported in Quarterly Statement of TDS (Form 24Q).

9. Further, as per Circular ०४/२०१३ dated १७/०४/२०१३ all deductors shall issue the Part A of Form No. १६, by generating and subsequently downloading it through TRACES Portal and after duly authenticating and verifying it, in respect of all sums deducted on or after the 1st day of April, २०१२ under the provisions of section १९२ of Chapter XVIIB. Part A of Form No १६ shall have a unique TDS certificate number. ‘Part B (Annexure)’ of Form No. 16 and Form 12BA shall be prepared by the deductor at his own and issued to the deductees after due authentication and verification along -with the Part A of the Form No. १६.

10. The proof of Income details & savings under various sections of Income Tax Act may be submitted as per the following scheduled dates:

| Last Date | Receipt of Form 12BB in F&A Division-CPCB Delhi by 16th December 2025 |

| Annexure | I & II along-with proof of the savings (self-attested) by 16th December 2025. Proof of savings made after 16th December 2025 must be submitted on or before 10th January 2026. Savings made after this date can be directly claimed by filing Income Tax Return. |

| Numbered Serially | All the enclosures must be numbered & arranged serially according to the format so that it may not lead to unattended. |

11. Soft copies of this circular & saving submission form 12BB, both are also available in the employees’ corner and CPCB e-office portal.

12. An early submission of “Form 12BB” from those employees who have opted old tax slabs is requested to avoid last minute hardship.

(विपिन गोयल)

लेखा अधिकारी

वित्त एवं लेखा विभाग, दिल्ली

COMMENTS