Tag: Income Tax Return

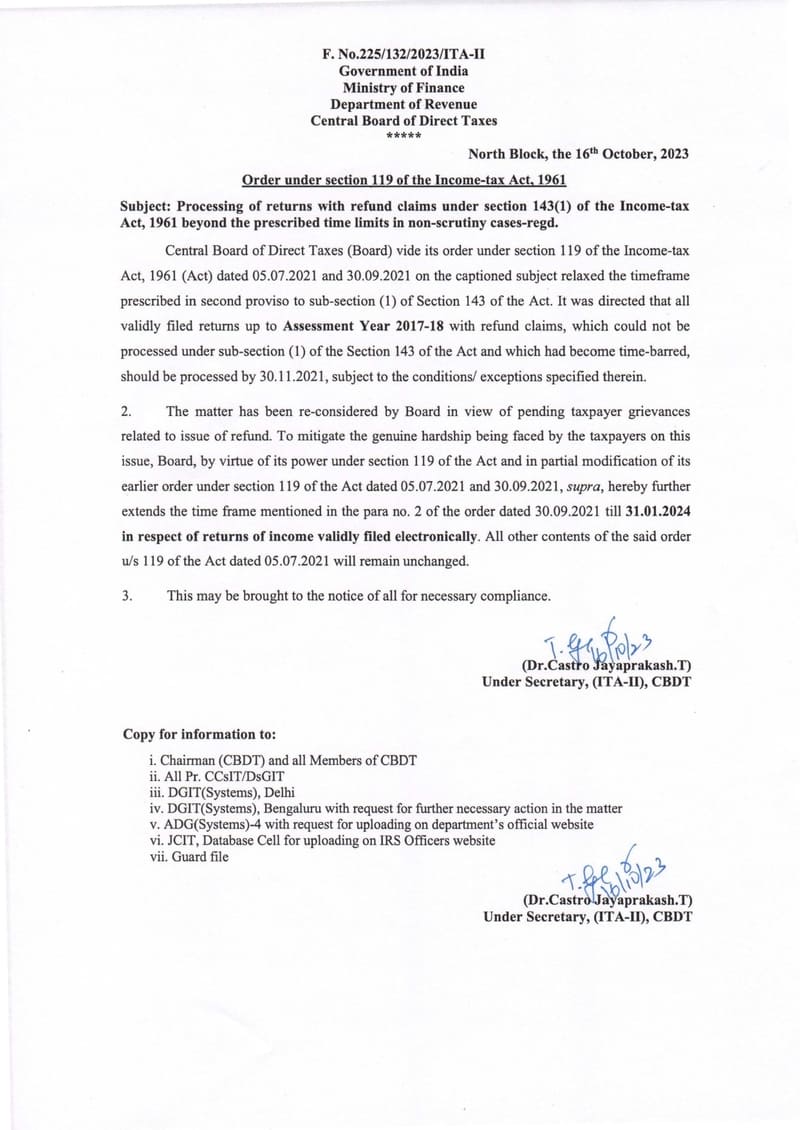

Processing of returns with refund claims under section 143(1) of the Income-tax Act, 1961 beyond the prescribed time limits in non-scrutiny cases – CBDT order under section 119 of the Income-tax Act, 1961

Processing of returns with refund claims under section 143(1) of the Income-tax Act, 1961 beyond the prescribed time limits in non-scrutiny cases - CB ...

Income Tax Return – Extension of last date for filling ITR : Latest update

Income Tax Return - Extension of last date for filling ITR : Latest update

ITR Due Date Extension: ITR फाइल करने की तारीख बढ़ी या नहीं? सरकार की तरफ ...

Alleged Harassment by Income Tax Authorities आयकर अधिकारियों द्वारा कथित रूप से परेशान किया जाना

Alleged Harassment by Income Tax Authorities आयकर अधिकारियों द्वारा कथित रूप से परेशान किया जाना

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT ...

Verification of Income Tax Return (ITR): Reduction of time limit from within 120 days to 30 days of transmitting the data of ITR electronically – CBDT Notification No. 05 of 2022

Verification of Income Tax Return (ITR): Reduction of time limit from within 120 days to 30 days of transmitting the data of ITR electronically - CBDT ...

ABC of Tax – Lets learn the basics : Everything about e-filing made easier

ABC of Tax – Lets learn the basics : Everything about e-filing made easier

Dear Individual Taxpayer,

As we continue making e-Filing easier, faster a ...

Income Tax Forms SAHAJ ITR-1, ITR-2, ITR-3, SUGAM ITR-4, ITR-5 & ITR-6 for Assessment Year 2022-23 (F.Y. 2021-22)

Income Tax Forms SAHAJ ITR-1, ITR-2, ITR-3, SUGAM ITR-4, ITR-5 & ITR-6 for Assessment Year 2022-23 (F.Y. 2021-22)

MINISTRY OF FINANCE

(Departmen ...

IT Circular No 17: Due date of furnishing Return of Income Tax for A.Y. 2021-22 extended to 31st December, 2021

IT Circular No 17: Due date of furnishing Return of Income Tax for A.Y. 2021-22 extended to 31st December, 2021

Circular No.17/2021

F. No. 225/49/20 ...

Extension of due dates for filing of Income Tax Returns for Assessment Year 2021-22 निर्धारण वर्ष 2021-22 के लिए आयकर रिटर्न दाखिल करने की नियत तारीखों का विस्तार

Extension of due dates for filing of Income Tax Returns for Assessment Year 2021-22 निर्धारण वर्ष 2021-22 के लिए आयकर रिटर्न दाखिल करने की नियत तारीखो ...

Income Tax : Extension of time lines for electronic fill of various Forms under the Income-tax Act,1961 – Circular No. 16/2021

Income Tax : Extension of time lines for electronic fill of various Forms under the Income-tax Act,1961 - Circular No. 16/2021

Circular No. 16/2021

...

Relief to Taxpayers : Extension of time limits of certain compliances in view of the severe pandemic: CBDT Circular No. 9 dated 20.05.2021

Relief to Taxpayers : Extension of time limits of certain compliances in view of the severe pandemic: CBDT Circular No. 9 dated 20.05.2021

Circular N ...