Payment of MIS/SCSS/TD accounts Monthly/Quarterly/Annual interest amount and maturity value of MIS/SCSS/TD/RD/KVP/NSC into account holder’s Bank Account by CBS Post Offices. Download ECS Mandate Form

SB Order No. 09/2021

F. No. FS-13/7/2020-FS

Govt. of India

Ministry of Communications

Department of Posts

(FS Division)

Dak Bhawan, New Delhi-110001

Dated: 30.04.2021

To,

All Head of Circles/Regions

Subject:- Payment of MIS/SCSS/TD accounts Monthly/Quarterly/ Annual interest amount and maturity value of MIS/SCSS/TD/RD/ KVP/NSC into account holder’s Bank Account by CBS Post Offices – Reg.

Sir/Madam,

The provision for payment of interest of MIS/SCSS/TD accounts and credit of maturity value for TDA type of accounts (MIS/SCSS/TD/RD/KVP/NSC) into account holder’s Bank Account has been implemented in Finacle through ECS Outward Credit functionality.

2. Chennai GPO is identified as Nodal Office for ECS Outward Credit functionality. Interest and Maturity credits through ECS Outward facility

3. The summary of the ECS Outward Credit facility is detailed below:-

(a) Credit of MIS/SCSS/TD Interest into account holders Bank Account:-

(i) Account holder will submit ECS Mandate Form along with passbook and a cancelled cheque or copy of first page of Bank passbook at concerned post office.

(ii) Counter PA will modify respective account and enter ECS details on the basis of cancelled cheque/copy of first page of Bank passbook in respective account modification menu.

(iii) Supervisor will verify the account modification and file the ECS mandate form in a Guard file.

(iv) On Due date of interest payment i.e. MIS/SCSS/TD the interest will be processed and credited in ECS Outward credit Suspense account. Chennai GPO will generate ECS files for uploading to NPCI. Interest will get credited to account holder’s other Bank Account on D+1 basis.

(b) Credit of MIS/TD/SCSS/KVP/NSC Maturity/Pre-mature closure value into account holder’s Bank Account.

(i) Account holder will submit account closure form along with passbook and a cancelled cheque or copy of first page of Bank passbook at concerned post office.

(ii) Counter PA will modify respective account and enter ECS details on the basis of cancelled cheque/copy of first page of Bank passbook in respective account modification menu.

(iii) Supervisor will verify the account modification and file ECS mandate form in a Guard file.

(iv) Counter PA will close account the account by selecting option “Customer Instruction” in respective scheme’s closure menu.

(v) Supervisor will verify account closure.

(vi) Supervisor will run HPR menu and print account closure report and handover to account holder as acknowledgement.

(vii) Chennai GPO will generate ECS credit file on next day for all such transactions and upload outward credit files to NPCI.

(viii) The interest and maturity value will be credited in the account holder’s Bank Account on D+1 basis i.e. Next working day.

(c) Handling of ECS returns due to incorrect account / closed account or other reasons.

(i) Chennai GPO will credit ECS return amount in respective Post Office’s ECS Outward Suspense Account (SOL ID+0098).

(ii) Respective post office will check ECS Outward Suspense Account (SOL ID+0098) and contact concerned account holder for intimating the ECS returns.

(iii) Respective post office will pay the ECS return amount through cash (below Rs.20,000) or by Cheque/credit into PO Savings Account (Rs.20,000 or more).

(iv) In order to avoid ECS returns for subsequent months, in respect of Interest pay outs, respective Post office will immediately modify the ECS mandate details in account modification menu by collecting new ECS Mandate form.

(v) If customer is unable to provide correct Bank account details, ECS mandate can be modified to No in account modification menu and verified by Supervisor.

4. A detailed “Standard Operating Procedure for Crediting MIS/SCSS/TD Interest and TDA Closures to OTHER BANK ACCOUNTS through ECS” has been prepared and enclosed herewith for information, guidance and necessary action.

5. The non-CBS Post Offices will continue to follow existing process .i.e. this functionality is not applicable in non-CBS Post Offices.

6. It is requested to circulate this amendment to all CBS Post Offices for information, guidance and necessary action. Same may also be placed on the notice board of all Post Offices in public area. Adequate promotion of this functionality is to be done to avoid cheque issuance and speedy payment to the depositors.

7. Hindi version will be issued in due course.

8. This issues with the approval of Competent Authority.

Enclosed:- i) Annexure

ii) ECS Mandate Form

Yours faithfully,

(Devendra Sharma)

Assistant Director (SB-II)

Annexure

Standard Operating Procedure for Crediting MIS/SCSS/TD Interest and TDA Closures to OTHER BANK ACCOUNTS through ECS

Introduction

Currently only MIS/SCSS Interest credits are paid through other bank accounts through outward ECS. Patches have been deployed for crediting Pre Mature / Post Maturity Closures of all TDA schemes to OTHER BANK ACCOUNTS through ECS Outward Credit (i.e. Through ECS credit in depositor‟s Other Bank Account). Electronic Mode of withdrawal (Outward Credit) will be in addition to Cash/Cheque /POSB modes. ECS Outward Credits are handled through NACH Outward Credit. Chennai GPO is nodal office for NACH. SBA Schemes (SB/SSA/PPF) are not covered under Electronic Mode of withdrawal currently.

Existing Difficulties in Issuing Postmaster Cheques for Maturity proceeds

The following difficulties are being faced currently in payment of closure proceeds through Postmaster Cheques

– Maximum Sub Offices are not authorized to issue cheque.

– Sub Offices are requesting cheque through respective HOs.

– It takes atleast 2 to 5 days for receipt of Cheque from HO.

– Account holder need to visit Post Office to collect cheque and visit his bank to deposit cheque in other bank account.

– As per latest GSPR, PMI is applicable till date of closure. Difference of interest is reported

due to difference in date of closure and date of receipt of cheque.

To overcome the above difficulties provision for crediting maturity/prematurity closure proceeds of TDA type of accounts (RD/TD/MIS/SCSS/KVP/NSC) developed in Finacle. The detailed process for transfer of maturity/pre-maturity proceeds/Monthly/Quarterly Interest in account holders OTHER BANK ACCOUNT is given below

Part-A

Monthly/Quarterly/Yearly Interest payment to Account Holder’s BANK ACCOUNT through ECS mode

If a depositor of MIS/SCSS/TD account desires that his/her periodic interest (monthly/quarterly/yearly as the case may be) to be credited directly in OTHER BANK ACCOUNT, depositor can avail this facility through ECS outward. The following process to be followed in such cases.

i) This facility can be availed at the time of opening of account or any time before maturity. If ECS facility for interest payout is opted after account opening, SOL has to ensure that the interest amount available in Sundry accounts, if any, is paid out separately. ECS instruction will be effective from the next payout onwards.

ii) To avail this facility depositor shall submit ECS Mandate form at the time of account opening or thereafter.

iii) With ECS mandate form depositor shall submit passbook, a cancelled cheque leaf or first page of other bank passbook at the concerned Post Office.

iv) After receipt of ECS Mandate form, counter PA will check the name of depositor on

cancelled cheque leaf or first page of passbook with respective POSB account‟s passbook.

v) User to invoke the respective account modification menu and update ECS mandate for existing accounts.

i.e. CMISAM – MIS/TD

CSCAM – SCSS

vi) ECS details can be updated during new account opening also.

Procedure for updating ECS Mandate details in Account Opening/Account Modification menus

ECS

| ECS Flag | Yes | |

| Flow code | Monthly/Quarterly/Yearly Interest Payout | |

| IO (Interest Outflow) alone to be selected from searcher for Interest Payout. | ||

| ECS Mandate details | ECS Mandate details to be entered | |

| PaySys id | Select ECS and click on empty space/tab-out, so that Account ID of nodal office will be auto populated in Account ID field | |

| Transaction Code | CODE1 ONLY to be selected from searcher. | |

| Other Party A/c. id | Account holder’s OTHER BANK ACCOUNT number. User to note that this account number cannot be validated in Finacle, and hence number should double-checked before clicking Submit to avoid mistakes. | |

| Other Party name | Name of customer as per OTHER BANK ACCOUNT | |

| Other Bank/Branch City Code | This field is disabled. This will get auto populated once MICR Code field is entered correctly. | |

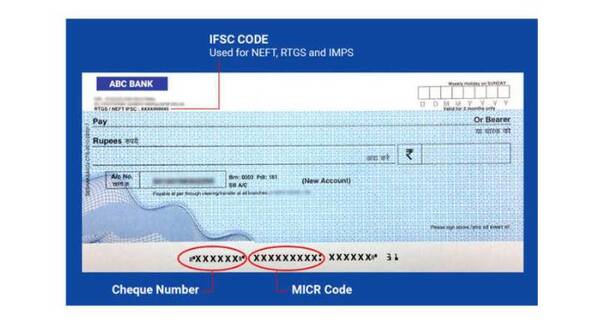

| MICR Code | MICR code available on cheque/passbook is of 9 digits i.e. 302002024 (here 302 is MICR City code, 002 is the MICR Bank code and 024 is the MICR Branch Code)Enter 9 digits of MICR code in this field | |

Note: – User shall enter value in above mentioned fields only, User shall not enter or change any value in other fields.

vii) Click on Submit.

viii) After modification, the account should be verified by the Supervisor.

ix) ) Supervisor must tally account number, depositor name, city code, bank code, branch code with mandate form, cancelled cheque/copy of first page of passbook.

x) ECS mandate form shall be filed in a Guard file in the Post Office.

ECS Mandate Form

ECS-I

Electronic Clearing Service (ECS) for Credit Clearing Mandate Form

(Account holder‟s option to receive payment through Credit Clearing Mechanism)

1. Name of Account Holder(s) : –

2.

| SL. No. | Type of Account (MIS/SCSS/TD) | Account Number |

| 01 | ||

| 02 | ||

| 03 | ||

| 04 | ||

| 05 |

2. Account Number (MIS/TD/SCSS etc) : –

3. Particulars of Bank Account in which interest amount to be credited:

A. Name of the Bank : –

B. Name of the branch : –

C. Bank Account Number (Savings) & Code :-

D. 9- Digit MICR Code : –

Note:- Please attach a blank cancelled cheque or self attested photocopy of front page of your savings account passbook issued by your bank for verification of the above particulars.

4. Mobile Number: –

5. Date of Effect: –

i) I hereby declare that the particulars given above are correct and complete. If the transaction is delayed or not effected at all for reasons of incomplete or incorrect information, I would not hold the Post Office or Bank responsible. I have read the conditions prescribed under Appendix I of POSB (CBS) Manual for ECS facility.

ii) In case of ECS returns due to any reason, I will take payment of ECS return amount from the concerned Post Office.

Date: –

(……………………………………….)

Signature of the Account holder(s)

Certified that the particulars furnished above are correct as per our records.

Date Stamp

(……………………………………….)

Signature of the APM/SPM/PM with stamp

Part-B

Premature/Maturity closures to Account Holder’s BANK ACCOUNT through ECS

i) At the time of premature/maturity closure, depositor to write Bank Account No, MICR code and Mobile number in Acquittance portion of Account Closure/Premature Closure form along with cancelled cheque/copy of first page of other bank passbook along with his/her passbook and account closure/premature closure form.

ii) Counter PA shall tally the name of the depositor with Cancelled cheque leaf/copy of bank passbook.

iii) Counter PA shall enable ECS option through account modification menu of the relevant scheme.

i.e. CMISAM – MIS/TD/NSC, KVP issued on or after 01.07.2016

CSCAM – SCSS,

CSCACM – NSC/KVP certificates issued before 01.07.2016

CRDACM– RD

iv) The following fields alone to be entered in respective account modification menu. User shall not enter any value/change value in remaining field.

Procedure for updating ECS Mandate details in Account Modification menus

ECS

| ECS Flag | Yes | |

| Flow code | Pre Mature/Maturity Closures | |

| 1. For TD/MIS/SCSS account user need to select ‘IO’ (Interest Outflow) flow code (for PMI) and then Add ‘PO’ (Principal Outflow) flow separately. If IO is already available for Interest, PO alone to be selected before closure. 2. For NSC/KVP and RD accounts, TO (Total Outflow) flow code to be selected |

||

| ECS Mandate details | ECS Mandate details to be entered | |

| PaySys id | Select ECS and click on empty space/tab-out, so that Account ID of nodal office will be auto populated in Account ID field | |

| Transaction Code | CODE1 ONLY to be selected from searcher. | |

| Other Party A/c. id | Account holder’s OTHER BANK ACCOUNT number. User to note that this account number cannot be validated in Finacle, and hence number should double-checked before clicking Submit to avoid mistakes. | |

| Other Party name | Name of customer as per OTHER BANK ACCOUNT | |

| Other Bank/Branch | This field is disabled. This will get auto populated once | |

a. Click on Submit.

Note:

- Both PO (Principal Outflow) & IO (Interest Outflow) flow code to be selected for TD/MIS/SCSS accounts one by one. Both PO and IO flow codes will be available for TD/MIS/SCSS accounts.

- For NSC/KVP/RD accounts, ONLY TO (Total Outflow) flow code to be selected. Only TO flow code will be available for NSC/KVP/RD.

- For existing accounts where ECS is already enabled, MICR Code field will be blank. This can be updated with existing MICR code if required.

- In case any MICR code is not available in the database respective PO will take up the issue through CPC to CEPT for addition of that MICR code.

vi) After enabling ECS as prescribed above, account modification is to be verified by Supervisor. Supervisor must ensure correctness of Bank Account Number, Account holder Name, City code, Bank Code and Branch code from cancelled cheque leaf/copy of first page of other bank passbook. MICR Code entered under ECS Mandate details table will be available for verification.

vii) After verification of account modification, Counter PA should proceed for Account closure through respective closure menu. One new mode of repayment “Customer Instruction” is available for selection in Closure menus under Close Mode (HCAACTD menu) and Repayment Mode (CRDCAAC & CSCCAAC).

During Closure, Customer Instruction option should be selected from the Repayment Mode/Close Mode dropdown if the PreMature/Maturity Proceeds are to be credited to Other Bank Account.

a. CRDCAAC _ RD Closure

b. CSCCAAC – SCSS Closure

c. HCAACTD – TD/MIS/KVP/NSC

Note:

1. Error “Customer instruction close mode can be used only when ECS is enabled for PO and IO” will be thrown during closure if PO or IO alone is selected for MIS/SCSS/TD accounts.

2. Error “For A/c ID xxxxx Customer Instruction Close Mode can be used only when ECS is enabled and Proper Mandate is given” will be thrown during closure if TO is not selected for NSC/KVP/RD accounts.

viii) Account closure to be verified by the Supervisor.

ix) After verification of Closure, account closure report will be automatically generated in Supervisor login.

x) Supervisor will invoke HPR menu and print account closure report generated in Finacle. This report has to be printed immediately as print logs will be cleared frequently.

xi) Supervisor will sign and seal on this account closure report and provide the closure report as acknowledgement of account closure to the customer.

xii) ECS mandate form along with cancelled cheque leaf/copy of first page of passbook to be attached with account closure form/premature account closure form and sent to SBCO along with vouchers.

Note:-

i) ECS Outward Credits are routed through NACH Outward Credit (National Automated Clearing House)

ii) Chennai GPO is Nodal office for ECS Outward credits. Hence ECS Outward Credit Suspense office account (600001000098) will be defaulted in Account ID field during selection of ECS flag. This is currently editable field. Post offices not to change this account ID.

iii) After successful closure and verification, Pre Mature/Maturity Closure proceeds will be credited into Nodal Sol ECS Outward Credit Suspense account (600001000098).

iv) Chennai GPO will generate ECS Outward file on the next working day and upload to NPCI for crediting into other bank accounts.

v) Customers will get their maturity credits on D+1 working day (D = Date of Closure) in other bank account.

vi) ECS Outward credit facility is not available for

a. SB, PPF, SSA, NSS87 and NSS92 schemes closures

b. NSC/KVP Bulk closures using menu CNSBCV

vii) Maturity value/Premature closure in case of deceased claim closure may also be credited through ECS Outward Credit facility. For the purpose nominee/claimant shall submit copy of deceased claim sanction along with cancelled cheque/copy of first page of passbook of his/her account.

viii) ECS Outward credit facility can be used for Death Claim cases also. Bank accounts of Nominee/Legal heir can be updated in ECS Mandate details.(this can be removed sir)

REPORTS

Counterwise Report for ECS

1. PO can generate Counter wise Report for ECS in HFINRPT for a given date range

2. From date and To date and sol id are input fields

3. Both Interest/Closure accounts which were credited through ECS to other bank will be listed in this report.

4. Supervisor will check and verify with ECS mandate form received for the date with this report and after tallying place in a guard file.

Handling of ECS Returns

1. ECS Outward credit might get returned due to incorrect other bank account number or account already closed.

2. Nodal office (Chennai GPO) will credit the ECS return amount to Outward credit ECS Suspense account (SOL ID+0098) of concerned CBS Post Office. Account Number will be updated in the reference number field on next day immediately after receipt of ECS returns.

3. Customer will visit concerned PO in case the amount is not credited in other bank account. Concerned POs will regularly check credits in ECS suspense account (SOL ID+0098).

4. If any ECS is returned and credits if available in ECS suspense account (SOL ID+0098) concerned Post Office will intimate the depositor reason for non credit of ECS through mobile number available with Post office requesting customer to attend Post Office for collecting maturity value as cash if maturity value is below Rs.20000/-.

5. If the maturity credits are above Rs.20000/-, amount to be credited into Postmaster Cheque office account (SOL ID+0340) from ECS Suspense account and to be paid as Postmaster cheque . In case of Sub Office they will collect the cheque from their respective HO.

6. PO will use CTM menu for debiting ECS Outward credit of their SOL and pay in Cash if the amount is below Rs.20000/. If the amount is above Rs.20000/-, PO will use CXFER to crediting from ECS Suspense to their 0340 account for paying through cheque.

7. Post office should pay Cash or Cheque ONLY if ECS return amount is available as credit in ECS Outward credit Suspense account (SOL+0098).

Role of Circle CPCs

1. Chennai GPO will send mail to all CPCs on the failed ECS records daily

2. Concerned CPC will guide the respective SOL to contact customer for payment through cash (if below Rs.20000/- or through cheque)

3. CPC will guide the POs that ECS Suspense account is to debited only if valid credits are available.

4. Circle CPC will guide the PO to modify the ECS Mandate by getting revised ECS Mandate from customer in case of ECS failure for interest credits to avoid failure in subsequent months.

5. CEPT Team will share list of offices where 0098 is Non Zero on weekly basis to all CPCs/uploaded in MIS Portal. This should be forwarded to all POs.

Role of SBCO

1. On receipt of voucher by SBCO, SBCO will generate counterwise report for ECS from production server for respective office.

2. After generating this report SBCO will tally account number, MICR code available in counterwise report for ECS with cancelled cheque leaf/copy of first page of passbook attached with account closure/premature closure form.

3. SBCO will also check the Non Zero ECS outward credits office account (SOL ID+0098)and ensure that no debits are done without valid credits.

Role of Inspecting Authorities.

1. During course of inspection of the CBS office respective guard file of mandate form to be checked and tallied with Counter wise Report for ECS in HFINRPT for a given date range.

2. Ideally ECS returned customer should be contacted and maturity/Interest amount to be paid by concerned PO. Monitor transactions in ECS Outward credit suspense account (0098) through HACLINQ menu and also ensure that the balance of this office account should be zero.

3. In case of any discrepancy, issue necessary instruction to clear pendency and record reason and result.

STANDARD OPERATING PROCEDURE FOR ECS OUTWARD CREDIT AT NODAL OFFICE CHENNAI GPO

Role of Nodal office (Chennai GPO)

1. Chennai GPO is the nodal office of ECS Outward credit

2. ECS outward credit Suspense account of Chennai GPO will be populated in all ECS closure/interest credits.

3. Chennai GPO will generate ECS Outward credit txt file on next day and submit to NPCI before 8:00 AM to NPCI without fail.

4. Interest /Maturity /Premature closure ECS credits will get included in single txt file

5. This file will be uploaded to NPCI after regular validations.

6. ECS credits may get rejected due to reason like other bank account number incorrect, account closed.

7. Chennai GPO will share the list of SOLs which has ECS returns to CEPT EOD team for enabling Intersol parameter for these SOLs ECS Outward Credit Suspense account.

8. CEPT EOD team immediately on receipt of information from Chennai GPO will enable Intersol only for those SOL (SOL ID+0098) accounts and send confirmation to Chennai GPO.

9. Chennai GPO will credit the return amount to concerned SOL ECS Outward credit Suspense account (SOL ID + 0098) through HTTUM in bulk. This should be done daily without fail immediately on receipt of ECS RETURNS. (Process). This should be done daily without fail.(This can be removed)

10. Chennai GPO will intimate EOD team to revert Intersol parameter once the amount is transferred.

11. CEPT EOD team will disable intersol paramter for the sols which were enabled immediately after receipt of confirmation from Chennai GPO.

12. Chennai GPO will send report to all CPCs daily on the list of ECS failed records.

13. ECS Rejected account customer will be paid in cash in concerned SOL by debiting ECS Outward credit suspense account ONLY if CREDITS are available in ECS Outward Credit Suspense account using CTM menu.

14. Rejected account customer will be paid in cheque in concerned SOL if amount exceeds Rs.20000/- by debiting ECS Outward credit suspense account (SOL ID+0098) and crediting to Postmaster cheque account (SOL ID+0340).

15. ECS_ECS Remittance Report available in HFINRPT will be used in Chennai GPO Nodal office to check details of accounts included in the ECS txt file

ECS filename and ECS file generation date will be mandatory inputs fields.

16. Chennai GPO will prepare a statistical register for No of ECS Outward and ECS returns.

Click here to view/download the PDF

COMMENTS