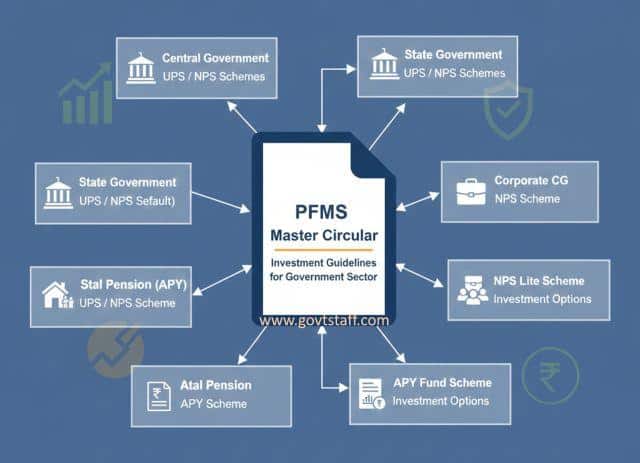

Investment Guidelines for Government Sector – UPS/NPS/APY Schemes- Central/ State Government (default), Corporate CG, NPS Lite, Atal Pension Yojana and APY Fund Scheme – PFRDA Master Circular dated 10.12.2025

MASTER CIRCULAR

PFRDA/Master Circular/2025/05/PF-03

Date: 10th December 2025

To

The CEOs of All Pension Funds & NPS Trust

All other NPS Stake Holders

SUBJECT: Master Circular on Investment Guidelines for Government Sector – UPS/NPS/APY Schemes- Central/ State Government (default), Corporate CG, NPS Lite, Atal Pension Yojana and APY Fund Scheme.

- This Master Circular is being issued in exercise of powers of the Authority conferred under sub-clause (b) of sub-section (2) of Section 14 read with Section 23 of the PFRDA Act, 2013 and sub-regulation (1) of Regulation 14 of PFRDA (Pension Fund) Regulations, 2015 as amended from time to time.

- This master circular supersedes the earlier circular dated 28.03.2025 and all the circulars/ letters mentioned in the Appendix.

- This master circular shall be effective immediately.

Yours sincerely

K MOHAN GANDHI

Digitally signed by

K MOHAN GANDHI

Chief General Manager

Appendix

|

INDEX |

| Part I – Introduction |

| Part II – General Guidelines |

| Part III – Investment Guidelines |

| Part IV – List of circulars/ letters consolidated in the Master Circular |

Part I – Introduction

The Pension Fund Regulatory and Development Authority (Pension Fund) Regulations, 2015, as amended from time to time, stipulate that the pension funds shall manage the pension schemes in accordance with the investment guidelines issued by the Authority for the benefit of the subscribers.

Part II – General Guidelines

i. The compliance obligation of the intermediary/entity shall not be confined merely to the Master Circular but, also the applicable laws.

ii. This Master Circular shall take immediate but shall be without prejudice to their (earlier issued circulars) operation and effect, for the period when they were in force, until them being subsumed under the Master Circular. Based on the above caveat, Part IV containing the list of circulars/ letters consolidated in the Master Circular shall stand rescinded with the issuance of this Master Circular, such that they are subsumed in the Master Circular and for all purpose and intent, remain operative, with no break of continuity.

iii. Notwithstanding such rescission of any circular, upon their merger in the Master Circular, or otherwise, anything done or any action taken or purported to have been done or taken, or to be taken hereafter, under the circulars/ letters now rescinded (for the period of their operation) shall be construed to have been validly taken as if the said circulars are in full force and effect and shall remain unaffected by their rescission, in any manner.

iv. The previous operation of the rescinded circulars or anything duly done or suffered thereunder, any right, privilege, obligation or liability acquired, accrued or incurred, any penalty, any order passed, any violation committed, any investigation, legal proceedings pending in terms of the circular (now rescinded), shall be treated as if the circulars are in full force and effect, and shall remain unaffected by their rescission, in any manner.

Part III – Investment Guidelines

The Investment Guidelines for UPS/NPS/APY Schemes viz. Central/ State Government (default), Corporate CG, NPS Lite, Atal Pension Yojana and APY Fund Scheme are as under –

| Category | Investment Pattern | Permissible Limit |

| (i) |

Government Securities and Related Investments: (a) Government Securities, (b) Other Securities {‘Securities’ as defined in section 2(h) of the Securities Contracts (Regulation) Act, 1956} the principal whereof and interest whereon is fully and unconditionally guaranteed by the Central Government or any State Government and also includes fresh issuance of “Govt. of India- Fully Serviced Bonds” issued by Public Sector Undertakings under Extra Budgetary Resources (EBR) after 3rd Jun 2020. Provided that the portfolio invested under this sub-category of securities shall not exceed 10% of the total Govt. Securities portfolio in the concerned Scheme at any point of time. (c) Units of Mutual Funds set up as dedicated funds for investment in Govt. securities and regulated by the SEBI. Provided that the portfolio invested in such mutual funds shall not exceed 5% of the total Govt. Securities portfolio in the concerned Scheme at any point of time. |

Up to 65% |

| (ii) |

Debt Instruments and Related Investments: (a) Listed (or proposed to be listed in case of fresh issue) debt securities issued by bodies corporate, including banks and public financial institutions (Public Financial Institutions as defined under Section 2 of the Companies Act, 2013). (b) Listed (or proposed to be listed in case of initial offering) Basel III Tier-1 bonds issued by scheduled commercial banks, AIFIs and Govt owned NBFCs under RBI Guidelines. Provided that the portfolio invested in this sub-category shall not exceed 2% of the concerned Scheme AUM at any point of time. No investment in this sub-category in initial offerings shall exceed 20% of the initial offering. Further, at any point of time, the aggregate value of Tier I bonds of any particular Bank held across all schemes managed by the Pension Fund shall not exceed 20% of such Tier I Bonds issued by that Bank. (c) Rupee Bonds issued by institutions of the International Bank for Reconstruction and Development, International Finance Corporation and Asian Development Bank. (d) Term Deposit receipts of more than one year duration issued by scheduled commercial banks, which meets the regulatory requirement of Net worth and Capital to Risk Weighted Asset Ratio as stipulated by Reserve Bank of India and additionally satisfy the following conditions on the basis of published annual report(s) for the most recent years, as required to have been published by them under the law: (i) having declared profit in the immediately preceding three financial years; (ii) having net non-performing assets of not more than 4% of the net advances; Provided that such Term Deposits with any one scheduled commercial bank including its subsidiaries should not exceed 10% of the concerned Scheme AUM at any point of time. (e) Units of Debt Schemes of Mutual Funds as regulated by SEBI. Provided these schemes shall exclude schemes of mutual funds having investment in short term debt securities with Macaulay Duration of less than 1 year. Provided further that the portfolio invested in such mutual funds shall not exceed 5% of the total debt instruments portfolio in the concerned scheme at any point of time. (f) Debt securities issued by Real Estate Investment Trusts (REIT) regulated by the SEBI. (g) Debt securities issued by Infrastructure Investment Trusts (InVIT) regulated by the SEBI. (h) The following infrastructure related debt instruments: (i) Listed (or proposed to be listed in case of fresh issue) debt securities issued by body corporates engaged mainly in the business of development or operation and maintenance of infrastructure, or development, construction or finance of affordable housing. Further, this category shall also include securities issued by Indian Railways or any of the body corporates in which it has majority shareholding. This category shall also include securities issued by any Authority of the Government which is not a body corporate and has been formed mainly with the purpose of promoting development of infrastructure. It is further clarified that any structural obligation undertaken or letter of comfort issued by the Central Government, Indian Railways or any Authority of the Central Government, for any security issued by a body corporate engaged in the business of infrastructure, which notwithstanding the terms in the letter of comfort or the obligation undertaken, fails to enable its inclusion as security covered under category (i) (b) above, shall be treated as an eligible security under this sub-category. (ii) Infrastructure and affordable housing Bonds issued by any scheduled commercial bank, which meets the conditions specified in category (ii)(d) above. (iii) Listed (or proposed to be listed in case of fresh issue) securities issued by Infrastructure Debt Funds operating as a NBFC and regulated by Reserve Bank of India. (iv) Listed (or proposed to be listed in case of fresh issue) units issued by Infrastructure Debt Funds operating as a Mutual Fund and regulated by SEBI. It is clarified that, barring exceptions mentioned above, for the purpose of this sub-category (h), a sector shall be treated as part of infrastructure as per Government of India’s harmonized master-list of infrastructure sub-sectors. (i) Listed or proposed to be listed credit rated Municipal bonds. (j) Investment in units of Debt ETFs issued by Government of India specifically meant to invest in bonds issued by Government owned entities such as CPSEs, CPSUs/CPFIs and other Government organizations, etc. Provided that the portfolio invested in such Debt ETFs shall not exceed 5% of total debt instruments portfolio in the concerned scheme at any point of time. Provided that the investment under sub-categories (a), (b) and (h) (i) to (iv) of this category (ii) shall be made in such securities with at least AA rating or equivalent in the applicable rating scale from at least two credit rating agencies registered with SEBI. However, Pension Fund can invest up to 10% of the total debt instruments portfolio in such securities with AA rating or above in the applicable rating scale that are rated by a single rated agency registered with SEBI. Provided further that in case of the sub-category (h)(iii) the ratings shall relate to the NBFC and for the sub-category (h)(iv) the ratings shall relate to the investment in eligible securities of the Infrastructure Debt Fund. Provided further that under sub-category (h), Pension Fund can make investment in infrastructure companies rated not less than ‘A’ along with an Expected Loss Rating of ‘EL1’ Further though investments under this category (ii) require at least AA rating as specified above, Pension Fund can invest in securities having investment grade rating below ‘AA’, provided that, investments in securities rated from ‘AA-’ to ‘A’ shall not exceed 10% of the total debt instruments portfolio in the concerned scheme while making such investment. Any investments in securities rated below ‘AA’ in excess of 10% of the total debt instruments portfolio in the concerned scheme, the risk of default for such securities shall be fully covered with Credit Default Swaps (CDSs) issued under Guidelines of the RBI and purchased along with the underlying securities. Purchase amount of such Swaps shall be considered to be investment made under this category. Provided further that if the securities/entities have been rated by more than two rating agencies, the two lowest of all the ratings shall be considered. For sub-category (c), a single rating of AA or above by a domestic or international rating agency will be acceptable. For sub-category (a) and (c), the investments made in debt securities and Rupee Bonds with residual maturity period of less than three years on the date of investment shall be limited to 10% of the investments made in debt instruments portfolio during the preceding 12 months in the concerned Scheme. In case of securities where the principal is to be repaid in a single pay-out, the maturity of the securities shall mean residual maturity. In case the principal is to be repaid in more than one pay-out, then the maturity of the securities shall be calculated on the basis of weighted average maturity of the security. For sub-category (f) and (g), the Trust should be rated as ‘AAA’ or equivalent in the applicable rating scale by at least two credit rating agencies registered with SEBI. For sub-category (i), the Municipal Bonds should be rated ‘AAA’ or equivalent in the applicable rating scale by at least two credit rating agencies registered with SEBI. It is clarified that debt securities covered under category (i)(b) above are excluded from this category (ii). |

Up to 45% |

| (iii) |

Short-term Debt Instruments and Related Investments: (a) Money market instruments comprising of Treasury Bills, Commercial Paper and Certificates of Provided that investment in Commercial Paper issued by body corporates shall be made only in such instruments which have minimum rating of A1+ by at least two credit rating agencies registered with the SEBI. Provided further that if Commercial Paper has been rated by more than two rating agencies, the two lowest of the ratings shall be considered Provided further that investment in this sub-category in Certificates of Deposit of up to one year duration issued by scheduled commercial banks, will require the bank to satisfy all conditions mentioned in category (ii) (d) above. (b) Term Deposit Receipts of up to one year duration issued by such scheduled commercial banks which satisfy all conditions mentioned in category (ii) (d) above. (c) Investments in units of a debt scheme of a mutual fund as regulated by SEBI where investment is in short term securities with Macaulay duration of less than 1 year viz. Overnight fund, Liquid Fund, Ultra Short Duration Fund and Low Duration Fund with the condition that the average total asset under management of AMC for the most recent six-month period should be at least Rs 5000 crore. (d) Investments in Government Securities as Lender in Triparty Repo conducted over the Triparty Repo (Dealing) System (TREPS) provided by RBI through Clearing Corporation of India Limited (CCIL). |

Upto 10% |

| (iv) |

Equities and Related Investments: (a) Stocks which are constituents of NIFTY 250 Index are eligible for investments. However, constituent stocks of BSE 250 Index which are not part of NIFTY 250 Index are also eligible for investments. Provided that 90% of the Asset Class / Scheme AUM shall be invested only in to the top 200 stocks of NIFTY 250 Index with flexibility to invest up to 10% in the remaining eligible stocks. (b) Units of equity schemes of mutual funds regulated by the SEBI, which have minimum 65% of their investment in shares of body corporates listed on BSE or NSE Provided that investment in such mutual funds shall not exceed 5% of the total equity portfolio in the concerned scheme at any point of time and the fresh investment in such mutual funds shall not exceed 5% of the fresh inflows invested in the year. (c) Exchange Traded Funds (ETFs)/Index Funds regulated by SEBI that replicate the portfolio of either BSE Sensex Index or NSE Nifty 50 Index. (d) ETFs regulated by SEBI that are constructed specifically for disinvestment of shareholding of the Government of India in body corporates. (e) Exchange Traded Derivatives regulated by SEBI (f) Initial Public Offering (IPO), Follow on Public Offer (FPO) and Offer for Sale (OFS) of companies, approved by SEBI. |

Up to 25% |

| (v) | Asset Backed, Trust Structured and Miscellaneous Investments:

(a) Commercial mortgage-based securities (CMBS) or Residential mortgage-based securities (RMBS). (b) Units issued by Real Estate Investment Trusts (REITs) regulated by the SEBI. (c) Asset Backed Securities (ABS) regulated by the SEBI. (d) Units of Infrastructure Investment Trusts (InvITs) regulated by the SEBI. (e) Investment in SEBI Regulated ‘Alternative Investment Funds’ (Category I and Category II only). Investments in sub-category (e) (i.e. AIF – Cat. I and Cat. II) is allowed subject to: – (i) The permitted funds under category I are Start-up Funds, Infrastructure Funds, SME Funds, Venture Capital Funds and Social Venture Capital Funds as detailed in Alternative Investment Funds Regulations, 2012 by SEBI. (ii) For category II AIF as per Alternative Investment Funds Regulations, 2012 by SEBI, at least 51% of the funds of such AIF shall be invested in either of the Start-up entities, infrastructure entities or SMEs or venture capital or social welfare entities. (iii) Pension Fund shall invest only in those AIFs whose corpus is equal to or more than Rs.100 crore. (iv) The exposure to single AIF shall not exceed 10% of the AIF size. (v) Pension Funds to ensure that funds should not be invested in securities of the companies or Funds incorporated and operated outside the India in violation of Section 25 of the PFRDA Act 2013. (vi) The sponsors of the Alternative investment funds should not be the promoter in Pension Fund or the promoter group of the Pension Fund. (vii) The AIFs shall not be managed by Investment manager, who is (f) Units issued by Gold and silver ETF regulated by SEBI Provided that the aggregate investment under sub-category (e) in such AIFs for Govt Sector shall not exceed the 1% of the respective Scheme AUM managed by the Pension Fund. Provided that the aggregate investment under sub-category (f) shall not exceed the 1% of the respective Scheme AUM managed by the Pension Fund. Provided that investment under this category (v) shall only be in listed instruments or fresh issues that are proposed to be listed except in case of sub-category (e) above. Provided further that investment under this category shall be made only in such securities which have minimum ‘AA’ or equivalent rating in the applicable rating scale from at least two credit rating agencies registered by the SEBI. Provided further that in case of the sub-categories (b) and (d), the Trust should have minimum rating of ‘AAA’ or equivalent rating in the applicable rating scale from at least two credit rating agencies registered by SEBI. Provided further that if the securities/entities have been rated by more than two rating agencies, the two lowest of the ratings shall be considered. |

Up to 5% |

- Inflows to the aforesaid Schemes will be invested in the permissible categories stated above in a manner consistent with the specified maximum permissible percentage amounts to be invested in each such investment category, while also complying with such other restrictions as made applicable for various sub-categories of the permissible investments.

Inflows to the schemes shall be the sum of un-invested funds from the past and receipts like contributions to the schemes, dividend/interest/commission, maturity amounts/ sale proceeds of earlier investments etc., as reduced by redemptions and applicable charges. - At any given point of time the percentage of assets under each category should not exceed the maximum limit prescribed for that category and also should not exceed the maximum limit prescribed for the sub-categories, if any. However, asset switch because of any RBI mandated Government debt switch would not be covered under this restriction.

- If for any of the instruments mentioned above, the rating falls below the minimum permissible grade prescribed for investment in that instrument when it was purchased, as confirmed by one credit rating agency, the option of exit shall be considered and exercised, as appropriate, in a manner that is in the best interest of the subscribers. On these guidelines coming into effect, the above prescribed investment pattern shall be achieved separately for each successive financial year through timely and appropriate planning.

- The prudent investment of the inflows/funds within the prescribed pattern is the fiduciary responsibility of the Pension Fund. NPS Trust shall monitor the investment decisions of the Pension Funds with utmost due diligence.

- The Pension Fund and NPS Trust will take suitable steps to control and optimize the cost of management of the schemes.

- The NPS Trust and Pension Fund will ensure that the process of investment is accountable and transparent. It should be ensured that due diligence is carried out to assess risks associated with any particular asset before investment is made by the Pension Fund in that particular asset and also during the period over which it is held in the scheme. The requirement of ratings as mandated in this circular merely intends to limit the risk associated with investments at a broad and general level. Accordingly, it should not be construed in any manner as an endorsement for investment in any asset satisfying the minimum prescribed rating or a substitute for the due diligence prescribed for being carried out by the Pension Fund.

- For equity investments through stock brokers, the amount of brokerage that can be debited to the schemes shall not exceed 0.03% of the equity transaction amount inclusive of stamp duty and applicable taxes.

- Investments in Initial Public Offer (IPO), Follow on Public Offer (FPO) and Offer for Sale (OFS) are permitted subject to fulfilment of the following conditions: –

(i) Equity offering through IPO are proposed to be “listed” in BSE or NSE and full float market capitalization calculated at lower band of IPO issue price should be equivalent or greater than the market capitalization of the 250th company as per the Nifty 250 Index list.

(ii) Shares offered under Follow on Public Offer (FPO)/Offer for Sale (OFS) should be listed on BSE or NSE and constituent in the list of Top 250 stocks as per the Nifty 250 Index.

(iii) Board approved Investment Policy of Pension Funds should contain detailed guidelines/procedure for investments in IPO. Investments in Equity Shares through IPO/FPO or OFS shall be reported to NPS Trust within 30 days from the date of investment.

(iv) In case a Pension Fund has invested through IPO and it fails to be in the latest published list of NIFTY 250 Index, a time period of maximum one year from the date of listing shall be provided to the Pension Fund for making a decision on exiting such shares.

(v) PFs are allowed to invest in Shares through Secondary Market, eligible under i & ii.

12. Subsequent to any changes in the NIFTY 250 Index, Pension Funds would have to rebalance their portfolios in line with eligible stocks in a period of six months.

13. The following restrictions/filters are being enforced to reduce concentration risks in the scheme investments:

(a) NPS Equity investments shall be restricted to 5% of the ‘paid up equity capital’* of all the sponsor group companies or 5% of the total AUM under Equity portfolio, whichever is lower, in each respective scheme and 10% of the ‘paid up equity capital’ of all the non-sponsor group companies or 10% of the total AUM under Equity portfolio, whichever is lower in each respective scheme.

Paid up share capital: Paid up share capital means market value of paid up and subscribed equity capital.

Sponsor shall mean an entity described as “Sponsor” under Pension Fund Regulatory and Development Authority (Pension Fund) Regulations, 2015 and subsequent amendments thereto.

‘Group’ means two or more individuals, association of individuals, firms, trusts, trustees or bodies corporate, or any combination thereof, which exercises, or is established to be in a position to exercise, significant influence and / or control, directly or indirectly, over any associate as defined in Accounting Standard (AS), body corporate, firm or trust, or use of common brand names, Associated persons, as may be stipulated by the Authority.

Explanation: Use of common brand names in conjunction with other parameters of significant influence and / or control whether direct or indirect shall be reckoned for determination for inclusion as forming part of the group or otherwise.

All Pension Funds shall publish on their respective website a list of their group companies and those of their sponsor.

(b) NPS Debt investments have been restricted to 5% of the ‘net-worth’^ of all the sponsor group companies or 5% of the total AUM in debt instruments portfolio (excluding Govt. securities) whichever is lower in each respective scheme and 10% of the net-worth of all the non-sponsor group companies or 10% of the total AUM in debt instruments portfolio (excluding Govt. securities) whichever is lower, in each respective scheme.

Net Worth: Net worth would comprise of Paid-up capital plus Free Reserves including Share Premium but excluding Revaluation Reserves, plus Investment Fluctuation Reserve and credit balance in Profit & Loss account, less debit balance in Profit and Loss account, Accumulated Losses and Intangible Assets.

(c) Investment exposure to a single Industry shall be restricted to 15% of AUM under all Schemes managed by each Pension Fund as per Level-5 of NIC classification. Investment in scheduled commercial bank FDs would be exempted from exposure to Banking Sector.

(d) For investments made in Index Funds/ETF/Debt MF, the exposure limits under such Index Funds/ETF/Debt MF shall not be considered for compliance of the prescribed Industry Concentration, Sponsor/ Non-Sponsor group norms under these guidelines.

(e) Investment exposure norms for InvITs/REITs shall be as under:

- Cumulative Investments in Units and Debt Instruments of InvITs and REITs shall not exceed 3% of total AUM of the Pension Fund at any point of time.

- Pension Fund shall not invest more than 15% of the total outstanding debt instruments issued by single InvIT/REIT issuer.

- Pension Fund shall not invest more than 5% of the Units issued by a single InvIT/REIT issue.

13. The value of funds invested by Pension Fund in any mutual funds mentioned in any of the categories or ETFs or Index Funds shall be reduced from the respective scheme AUM, before computation of investment management fees payable to them, to avoid double incidence of costs. However, investments made by Pension Funds in MFs until the Scheme AUM reached Rs. 5 crores, in ETFs/Index Funds for the purpose of disinvestment of shareholding of the Government of India in body corporates, Bharat Bond ETF/Debt ETF issued by Government of India in respect of bonds issued by CPSEs, CPSUs, CPFIs and other Government organizations, Gold and Silver ETFs and all short duration mutual funds (liquid mutual fund, overnight fund ultra-short duration fund etc.) as permitted by SEBI, would be eligible for payment of investment management fee.

14. In APY Fund Scheme, there shall not be any deduction of NPS Trust charges/fee as the scheme is managed for a specific purpose.

15. Transfer of securities within schemes or inter scheme are allowed only if such transfers are done at the prevailing market price for traded instruments or at the valuation price for non-traded instruments and the securities so transferred are in conformity with the investment objective of the scheme to which such transfer has been made. Such transfers may be allowed in following scenarios:

- To meet liquidity requirement in a scheme in case of unanticipated redemption pressure

- To adjust securities received through corporate action.

The inter scheme transfers are allowed only on exceptional basis. The Pension Fund shall inform NPS Trust and Authority upon exercise of this option.

16. Pension Fund are permitted to keep securities as margin with the CCIL for margin requirements for investment in Government securities and Triparty Repo (Dealing) System (TREPS).

17. For National Pension Scheme Tier II – Tax Saver Scheme, 2020 (NPS–TTS) which is available for subscription only by Central Government employees, the following investments limits will apply;

| Asset Class | Limits |

| Equity (as per Asset Class E of NPS Tier-II) | 10% – 25% |

| Debt (as per Asset Class C & G NPS Tier-II) | Up to 90% |

| Cash/Money Market, Liquid Mutual Funds* | Up to 20% |

* this limit shall be applicable only after the scheme corpus reaches Rs 5 crore.

18. The prescribed limits in to different asset classes such as G-Sec, Corporate Bonds, Equity, Money Market Instruments, and ABS & Misc. Investments have increased from 140% to 150%, giving flexibility to the Pension Funds to choose among the instruments based on their independent risk – return analytic framework in the interest of the subscribers. It is, therefore, desirable that Pension Funds may choose to different asset- classes exposure gradually and in a phased manner based on their own risk assessment.

19. The following exemptions available to NPS Tier-II Schemes as stated in Master Circular for the Non-Govt Sector dated 10.12.2025 are also be applicable to Composite Tier II Scheme:

In addition to the permissible instruments of investments as mentioned above for each Scheme/Asset Class, Pension Fund can temporarily park the inflows/funds in short-term debt instruments and related investments as noted below subject to the following limits;

(ii) 20% of AUM for each of the Scheme/Asset Class under NPS Tier-II

(iii) the aforesaid limits shall not be applicable till the AUM of the respective Scheme/Asset Class reaches Rs 5 crore.

15. The exposure Norms at Para 13 of this Master Circular are not applicable to Composite Tier II Scheme till the Scheme/Asset Class AUM reaches Rs 5 crore.

Part IV – List of circulars consolidated in the Master Circular

| No | Circular Name | Date | Circular No. |

| 1. | Investment Guidelines | 15-10-2013 | PFRDA/2013/16/PFM/4 |

| 2 | Accounting Policy for Inflation linked Bonds | 11-12-2013 | PFRDA/2013/19/PFM/5 |

| 3. | Revision of Investment Guidelines for NPS Schemes | 29-01-2014 | PFRDA/2014/02/PFM/1 |

| 4. | Investment in Basel -III compliant Additional Tier I Bonds. | 22-09-2014 | PFRDA/2014/06/PFM/04 |

| 5. | Clarification on Revision of Investment Guidelines for NPS Scheme issued on 29.01.2014 | 22-01-2015 | PFRDA/2015/05/PFM/03 |

| 6. | Amendment to Revised Investment Guidelines for NPS schemes. | 31-03-2015 | PFRDA/2015/12/PFM/06 |

| 7. | Investment guidelines for NPS Schemes (Applicable to Scheme CG, Scheme SG Corporate CG and NPS Lite schemes of NPS and Atal Pension Yojana) w.e.f. 10th June, 2015. | 03-06-2015 | PFRDA/2015/16/PFM/7 |

| 8. | Advisory for all Pension Funds and Custodian regarding investments in Mutual Fund schemes | 14-02-2017 | Advisory |

| 9. | Clarification with respect to advisory for all the Pension Funds and Custodian regarding investments in Mutual Fund schemes. | 15-05-2017 | PFRDA/6/PFM/7/1 |

| 10. | Revised rating Criteria for investments under NPS Schemes -reg. | 08-05-2018 | PFRDA/2018/02/PF/02 |

| 11. | Change in Investment Guidelines for NPS Schemes w.r.t. investment in Equity Mutual funds by Pension Funds | 20-08-2018 | PFRDA/2018/56/PF/2 |

| 12. | Clarifications on Circular No. PFRDA/2018/56/ PF/2 dated 20th August, 2018 issued by the Authority for Change in Investment Guidelines for NPS Schemes | 02-11-2018 | PFRDA/2018/60/PF/3 |

| 13. | Amendment to the investment Guidelines (Applicable to Scheme CG, Scheme SG, Corporate CG and NPS Lite schemes of NPS and Atal Pension Yojana) | 25-03-2019 | PFRDA/2019/8/SUP-PF/2 |

| 14. | Change in Investment Guidelines for NPS Schemes- permitting Pension Funds to invest in Overnight Funds and all such short duration funds as may be permitted by SEBI from time to time | 20-11-2019 | PFRDA/2019/22/REG-PF/3 |

| 15. | Change in Investment Guidelines for NPS Schemes and other pension schemes administered by PFRDA | 29-06-2020 | PFRDA/2020/26/REG-PF/2 |

| 16. | Investment Guidelines – 2021 for NPS Schemes (Applicable to Scheme CG, Scheme SG, Corporate CG and NPS Lite scheme of NPS and Atal Pension Yojana) w.e.f. 20th July 2021. | 20-07-2021 | PFRDA/2021/28/REG-PF/2 |

| 17. | Guidelines for Investment by Pension Funds in an Initial Public Offer (IPO), Follow on Public Offer (FPO) and/or Offer for Sale (OFS) under National Pension System (NPS) and other Pension Schemes regulated/ administered by the Authority -reg. | 27-07-2021 | PFRDA/2021/32/REG-PF/4 |

| 18. | Clarification on Guidelines for investment by Pension Funds in IPO/ FPO and/ or OFS issued vide Circular dated 27.07.2021 -reg. |

16-09-2021 | PFRDA/2021/39/REG-PF/5 |

| 19. | Change in Operational Guidelines for National Pension Scheme Tier II- Tax Saver Scheme, 2020 (NPS – TTS) -reg. | 30-11-2021 | PFRDA/2021/47/REG-PF/09 |

| 20. | Change in Investment Guidelines-2021 for NPS Schemes (Applicable to Scheme CG, Scheme SG, Corporate CG and NPS Lite schemes of NPS and Atal Pension Yojana) -reg. | 30-11-2021 | PFRDA/2021/45/REG-PF/07 |

| 21. | Change in Investment Guidelines-2021 for NPS Schemes (Applicable to Scheme CG, Scheme SG, Corporate CG and NPS Lite schemes of NPS and Atal Pension Yojana) -reg. | 28-04-2022 | PFRDA/2022/09/REG-PF/01 |

| 22. | Change in Investment Guidelines-2021 for NPS Schemes (Applicable to Scheme CG, Scheme SG, Corporate CG and NPS Lite schemes of NPS and Atal Pension Yojana) -reg. | 18-11-2022 | PFRDA/2022/33/REG-PF/5 |

| 23. | Change in Operational Guidelines for National Pension Scheme Tier II- Tax Saver Scheme, 2020 (NPS – TTS) -reg. | 18-11-2022 | PFRDA/2022/35/REG-PF/7 |

| 24. | Permission for keeping of securities as margin with the CCIL for margin requirements-reg. | 20-04-2023 | PFRDA/2023/13/REG-PF/01 |

| 25. | Master Circular on Investment Guidelines for NPS/ APY Schemes- Central Government, State Government, Corporate CG, NPS Lite, Atal Pension Yojana and APY Fund Scheme | 18-08-2023 | PFRDA/ MASTERCIRCULAR/ 2023/01/PF-01 |

| 26. | Investment Guidelines and Asset Allocation for APY Fund Scheme | 15-03-2023 | Letter no. PFRDA/16/3/29/0123/2017-REG- PF |

| 27. | Master Circular on Investment Guidelines for UPS/ NPS/ APY Schemes- Central/ State Government (default), Corporate CG, NPS Lite, Atal Pension Yojana and APY Fund Scheme. | 28-03.2025 | PFRDA/Master Circular/2025/02/PF-01 |

COMMENTS