Latest Posts

Need for reporting accurate number of vacancies and adjustment of candidates to be appointed based on court directions: DoPT OM dated 03.11.2023

Need for reporting accurate number of vacancies and adjustment of candidates to be appointed based on court directions: DoP&T OM dated 03.11.2023

...

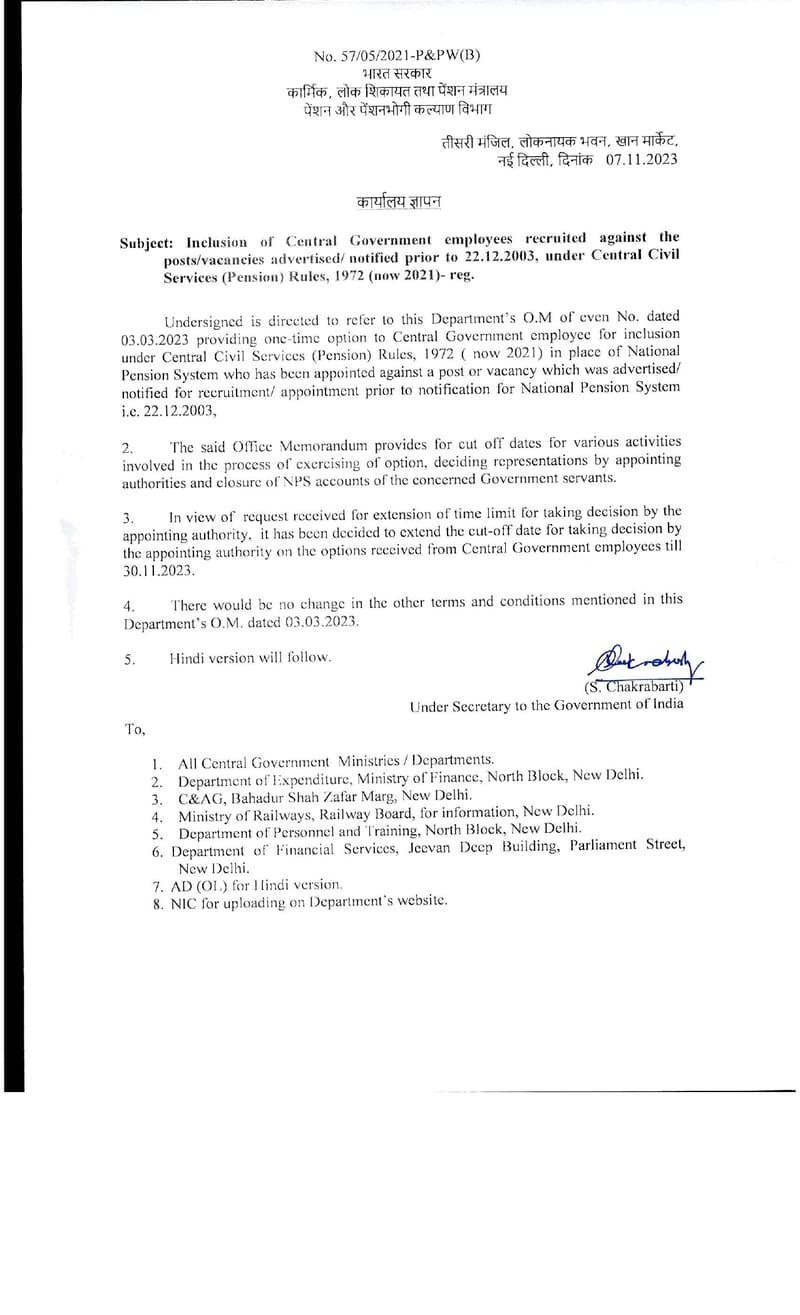

NPS to OPS : Extension of Cut-off Date for Central Government Employees’ Option Choices under Central Civil Services (Pension) Rules, 2022 till 30.11.2023

NPS to OPS : Extension of Cut-off Date for Central Government Employees' Option Choices under Central Civil Services (Pension) Rules, 2022 till 30.11. ...

Payment of advance against the Productivity Linked Bonus admissible for the eligible Group C and Group B (Non-gazetted) employees of EPFO for the year 2022-23

Payment of advance against the Productivity Linked Bonus admissible for the eligible Group C and Group B (Non-gazetted) employees of EPFO for the year ...

Training of Foreign Nationals and Non-Railway Organization Personnel on Indian Railways – Railway Board’s clarification regarding fee of the training

Training of Foreign Nationals and Non-Railway Organization Personnel on Indian Railways - Railway Board's clarification regarding fee of the training

...

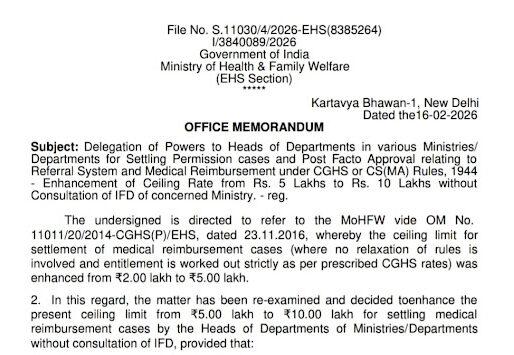

List of empanelled Health Care Organizations (HCOs) as on 25/10/2023 under CGHS Mumbai

List of empanelled Health Care Organizations (HCOs) as on 25/10/2023 under CGHS Mumbai

EMPANELLED HOSPITAL DETAILS (MUMBAI)

as updated on 25/10/2023 ...

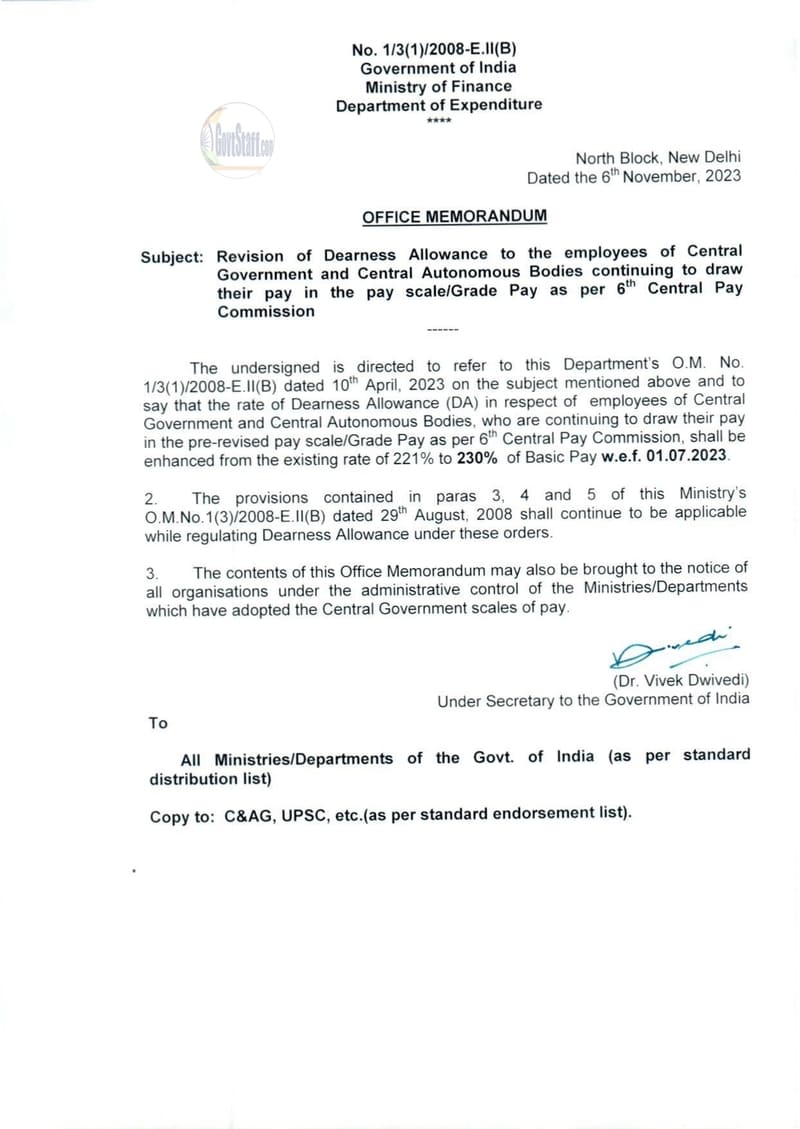

6th CPC Dearness Allowance @ 230% from Jul-2023 for CABs employees: FinMin OM dated 06.11.2023

6th CPC Dearness Allowance @ 230% from Jul-2023 for CABs employees: FinMin OM dated 06.11.2023

No. 1/3(1)/2008-E.II(B)

Government of India

Ministry ...

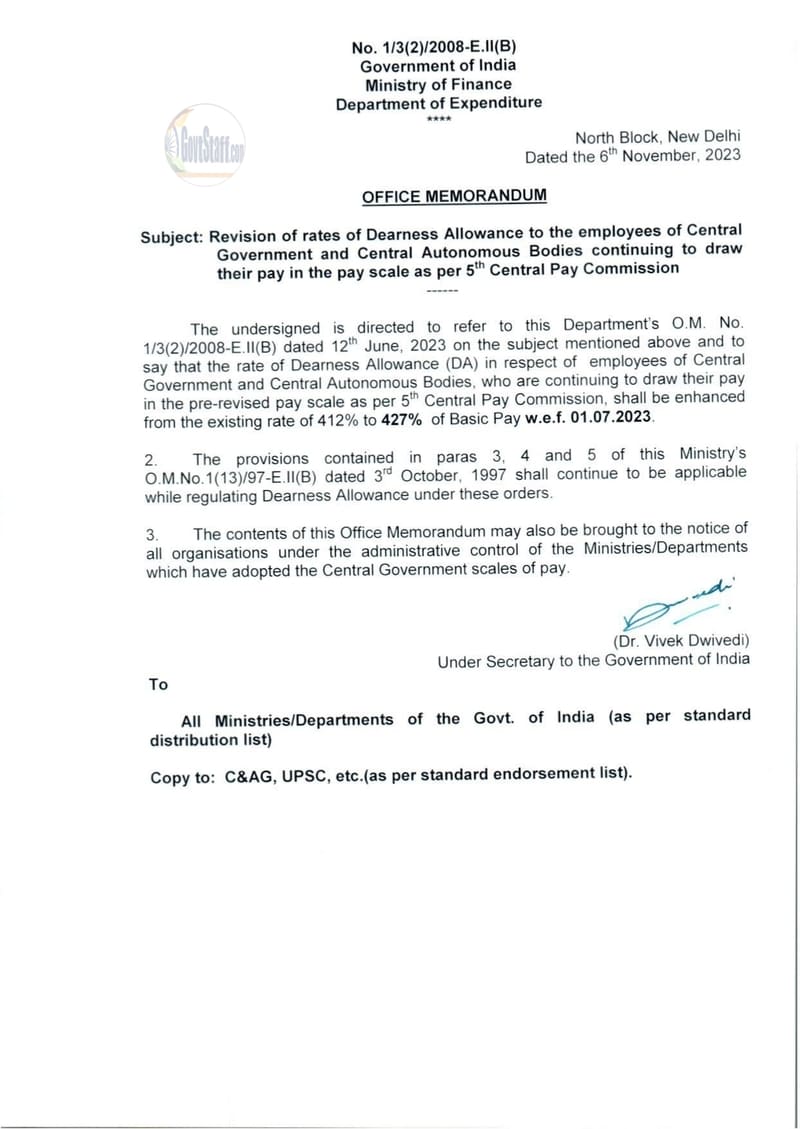

5th CPC Dearness Allowance @ 427% from Jul-2023 for CABs employees: DoE, Fin Min Order dated 06.11.2023

5th CPC Dearness Allowance @ 427% from Jul-2023 for CABs employees: DoE, Fin Min Order dated 06.11.2023

No. 1/3(2)/2008-E.II(B)

Government of India

...

Liberalization of provisions for withdrawal/ drawal of advance from the General Provident Fund by the subscribers – Master Circular by DoPPW

Liberalization of provisions for withdrawal/ drawal of advance from the General Provident Fund by the subscribers - Master Circular by DoPPW

F.No. 21 ...

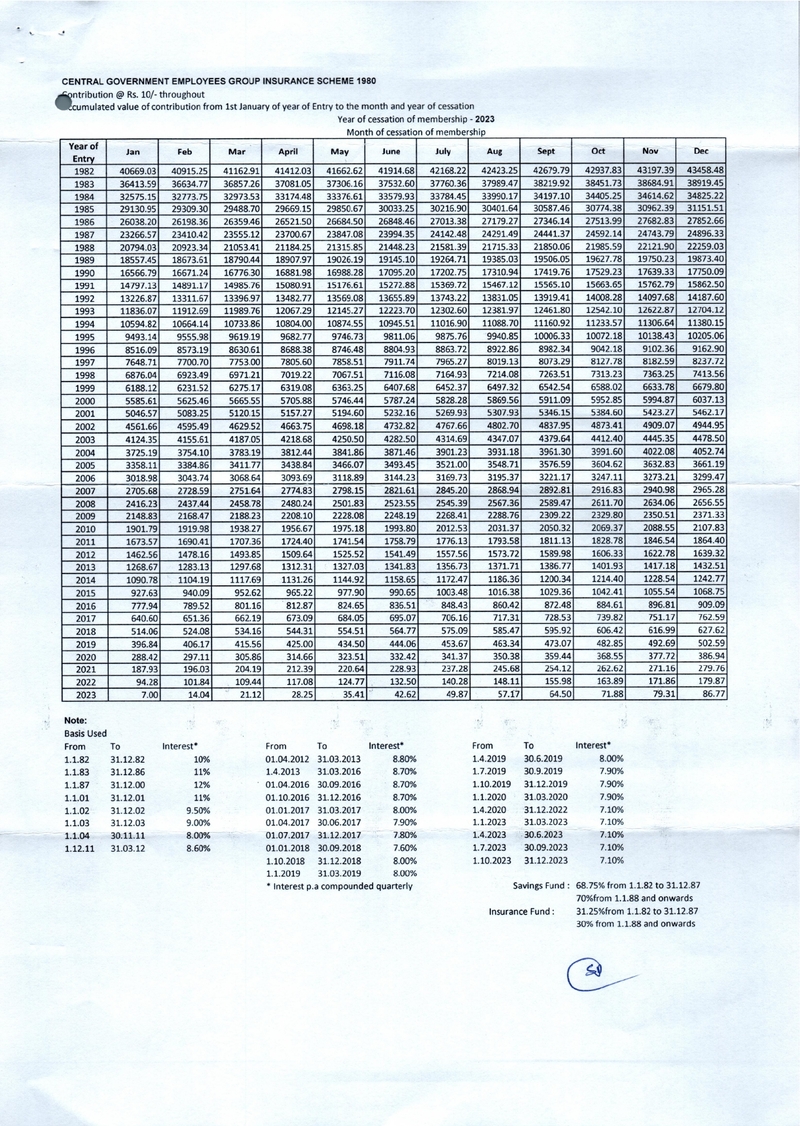

CGEGIS : Tables of Benefits for the savings fund for the period from 01.10.2023 to 31.12.2023

CGEGIS : Tables of Benefits for the savings fund for the period from 01.10.2023 to 31.12.2023

No. 5-18(01)/2023-PAT

Government of India

Ministry of ...

Guidelines issued by DPI: – Implementation thereof – Leasing of Houses for officers in the Central Public Enterprises.

Guidelines issued by DPI: - Implementation thereof - Leasing of Houses for officers in the Central Public Enterprises.

सं० W-02/0008/2023-DPE (WC)

व ...