Tag: Finance

CGEGIS Table of Benefits for the savings fund for the period from 01.10.2025 to 31.12.2025: O.M. dated 12.11.2025

CGEGIS Table of Benefits for the savings fund for the period from 01.10.2025 to 31.12.2025: O.M. dated 12.11.2025

No. 7(1)/EV/2023

Government of I ...

Maintenance of registers by PAOs/CDDOs as prescribed in Civil Accounts Manual, 2024 for accounting and reconciliation: CGA Order dated 07.11.2025

Maintenance of registers by PAOs/CDDOs as prescribed in Civil Accounts Manual, 2024 for accounting and reconciliation: CGA Order dated 07.11.2025

F. ...

Grant of Transport Allowance at double the normal rate for Central Government Employees with Disabilities: Compendium of Instruction issued by Finance Ministry vide O.M. dated 29.07.2025

Grant of Transport Allowance at double the normal rate for Central Government Employees with Disabilities: Compendium of Instruction issued by Finance ...

Avoid system overload during last hours of the end of FY 2024-25: CGA Advisory issued vide O.M. F.No. TA-2-03001(03)/1/2021-TA-II (E-5450)/64 dated 05.03.2025

Avoid system overload during last hours of the end of FY 2024-25: CGA Advisory issued vide O.M. F.No. TA-2-03001(03)/1/2021-TA-II (E-5450)/64 dated 05 ...

General Financial Rules 2017 (GFR-2017) : Amendment issued vide O.M. dated 10.07.2024

General Financial Rules 2017 (GFR-2017) : Amendment issued vide O.M. dated 10.07.2024

No.F.1/3/2024-PPD

Government of India

Ministry of Finance

D ...

Guidelines for Loss Write-Off by Subordinate Authorities under the Delegation of Financial Power Rules, 2024

Guidelines for Loss Write-Off by Subordinate Authorities under the Delegation of Financial Power Rules, 2024

F. No. 01(14)/2016-E.1I(A) (Part-ID)

Go ...

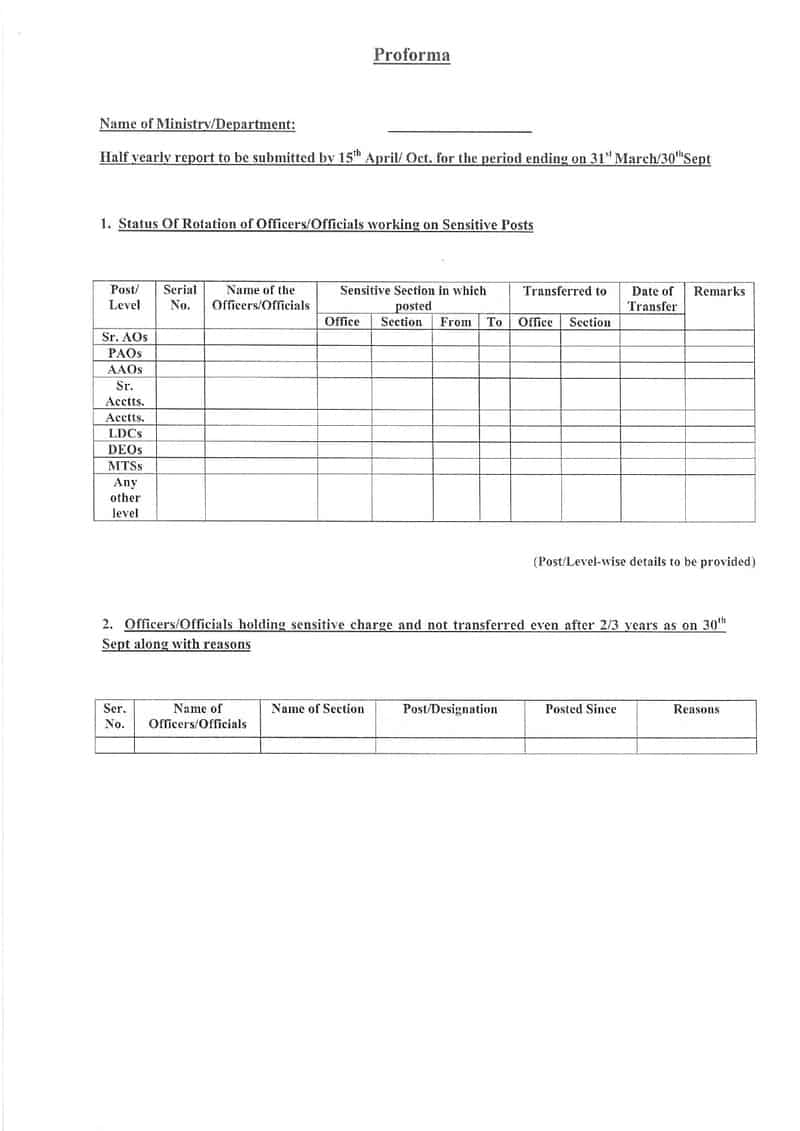

Submission of half yearly Compliance Report on Rotational Transfer of Officers/officials Working on Sensitive Posts by 15th October of each year

Submission of half yearly Compliance Report on Rotational Transfer of Officers/officials Working on Sensitive Posts by 15th October of each year

MOST ...

Deduction of Income-tax at any lower rate or no deduction of Income-tax under sub-section (1) of section 197 of the Income-tax Act, 1961 through TRACES – Procedure, format and standards for filling an application for grant of certificate under sub-rule (4) and its proviso of Rule 28AA of Income Tax Rules, 1962

Deduction of Income-tax at any lower rate or no deduction of Income-tax under sub-section (1) of section 197 of the Income-tax Act, 1961 through TRACE ...

Online NPS Subscriber Registration Module for PRAN generation – User Manual by CGA vide O.M. dated 25-09-2023

Online NPS Subscriber Registration Module for PRAN generation - User Manual by CGA vide O.M. dated 25-09-2023

F.No.-I-84001/1/2020-ITD-CGA/ces-748/387 ...

Statement showing Guarantees given by the Union Government – Amendment in Civil Accounts Manual Revised Second Edition-2007 Volume-I & II (Reprinted in 2012) – Correction Slip No. 34

Statement showing Guarantees given by the Union Government – Amendment in Civil Accounts Manual Revised Second Edition-2007 Volume-I & II (Reprint ...