Tag: Income Tax

31 मार्च तक पैन को आधार से लिंक कर लें – आयकर विभाग की अपील

31 मार्च तक पैन को आधार से लिंक कर लें – आयकर विभाग की अपील

Last dated to link your PAN and AADHAAR is approaching soon

पैन कार्ड को आधार नंबर से जो ...

Assessing and regularization of Income Tax for the F.Y- 2023-2024: DAD Circular No. 27

Assessing and regularization of Income Tax for the F.Y- 2023-2024: DAD Circular No. 27

Government of India

Ministry of Defence

Controller of Defenc ...

Income Tax on GPF accumulation – CGDA order dated 27.02.2023

Income Tax on GPF accumulation - CGDA order dated 27.02.2023

र्यालय, रक्षा लेखा महानियंत्रक

उलान बटा रोड, पालम, दिल्ली छावनी - 110010

Office of Co ...

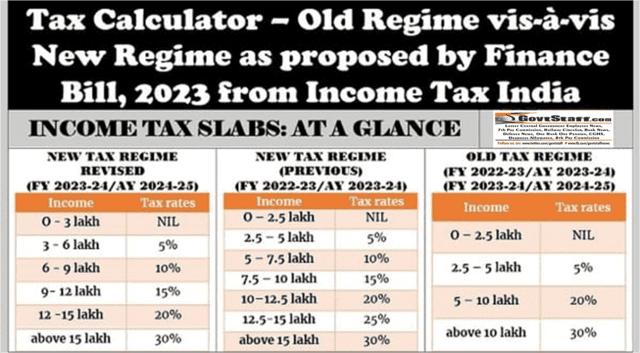

Income Tax Calculator – Old Regime vis-à-vis New Regime as proposed by Finance Bill, 2023 from IncomeTaxIndia

Income Tax Calculator – Old Regime vis-à-vis New Regime as proposed by Finance Bill, 2023 from IncomeTaxIndia

Finance Minister Nirmala Sitharaman has ...

Standard Deduction for tax calculation available for salaried employees वेतनभोगी कर्मचारियों के लिए उपलब्ध कर गणना के लिए मानक कटौती

Standard Deduction for tax calculation available for salaried employees वेतनभोगी कर्मचारियों के लिए उपलब्ध कर गणना के लिए मानक कटौती

GOVERNMENT OF IN ...

Forwarding of Employee Profile cum Transfer Request Proforma for Annual General Transfers 2023

Forwarding of Employee Profile cum Transfer Request Proforma for Annual General Transfers 2023

Office of the Pr. Chief Commissioner of Income Tax

An ...

Alleged Harassment by Income Tax Authorities आयकर अधिकारियों द्वारा कथित रूप से परेशान किया जाना

Alleged Harassment by Income Tax Authorities आयकर अधिकारियों द्वारा कथित रूप से परेशान किया जाना

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT ...

Income Tax Rates, TDS on Salaries and Rebate under Section 87A – Finance Bill 2023- Budget 2023-24

Income Tax Rates, TDS on Salaries and Rebate under Section 87A - Finance Bill 2023 - Budget 2023-24

FINANCE BILL, 2023

PROVISIONS RELATING TO

DIR ...

बजट में नौकरीपेशा के लिए बढ़ सकती है 80सी में छूट की सीमा, 75,000 रुपये हो सकती है स्टेंडर्ड डिडक्शन की सीमा

बजट में नौकरीपेशा के लिए बढ़ सकती है 80सी में छूट की सीमा, 75,000 रुपये हो सकती है स्टेंडर्ड डिडक्शन की सीमा

2014-15 में आखिरी बार बढ़ी थी लिमिट ...

Income Tax Demand Notice under section 143(1) due to mismatch of Tax credit for the Financial Year 2020-21 (AY 2021-22)

Income Tax Demand Notice under section 143(1) due to mismatch of Tax credit for the Financial Year 2020-21 (AY 2021-22)

O/o PCDA(O), Go ...