Tag: Income Tax

Calculation of taxable interest relating to contribution in a provident fund: Rule 9D of Income-tax Rules, 1962 – IT 25th Amendment Rules 2021

Calculation of taxable interest relating to contribution in a provident fund: Rule 9D of Income-tax Rules, 1962 – IT 25th Amendment Rules 2021

MINIST ...

Income Tax Exemption for treatment of COVID-19

Income Tax Exemption for treatment of COVID-19

केंद्र सरकार ने वित्तीय वर्ष 2019-20 और उसके बाद के वर्षों के दौरान किसी नियोक्ता या किसी व्यक्ति से C ...

Agenda notes for the 48th meeting of National Council JCM to be held on 26/06/2021

Agenda notes for the 48th meeting of National Council JCM to be held on 26/06/2021

By Speed Post

No. 3/4/2021-JCA

Government of India

Ministry of ...

Relief to Taxpayers : Extension of time limits of certain compliances in view of the severe pandemic: CBDT Circular No. 9 dated 20.05.2021

Relief to Taxpayers : Extension of time limits of certain compliances in view of the severe pandemic: CBDT Circular No. 9 dated 20.05.2021

Circular N ...

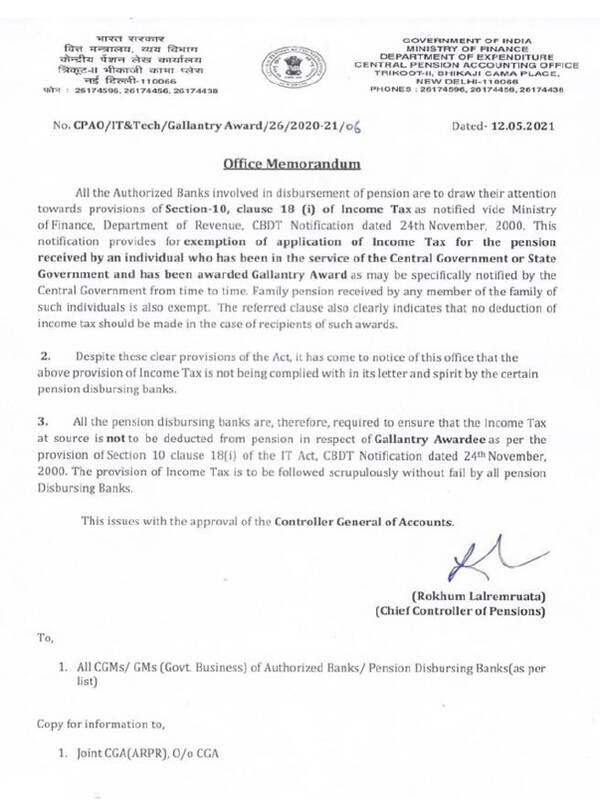

Non-Deduction of Income Tax at source from Pension in respect of Gallantry Awardee – CPAO O.M. dated 12.05.2021

Non-Deduction of Income Tax at source from Pension in respect of Gallantry Awardee - CPAO O.M. dated 12.05.2021

भारत सरकार GOVERNMENT OF INDIA

वित् ...

New Income Tax Return Forms for AY 2021-22: वर्ष 2021-22 के लिए नए आयकर रिटर्न फॉर्म

New Income Tax Return Forms for AY 2021-22: वर्ष 2021-22 के लिए नए आयकर रिटर्न फॉर्म

Ministry of Finance

प्रविष्टि तिथि: 01 APR 2021

The Central Bo ...

Income tax TDS & TCS rates effective from 01st April 2021: TaxGuru

Income tax TDS & TCS rates effective from 01st April 2021

TDS Rates effective from 01st April 2021

The concept of TDS was introduced ...

No Objection Certificate for obtaining passport / renewal of passport – Procedure for forwarding applications reg.

No Objection Certificate for obtaining passport / renewal of passport - Procedure for forwarding applications reg.

भारत सरकार / GOVERNMENT OF INDIA

...

Income Tax (3rd Amendment) Rules 2021: Revised Form No. 12BA, Revised Form No. 16 for Part B (Annexure) and Form No. 24Q Annexure-II

Income Tax (3rd Amendment) Rules 2021: Revised Form No. 12BA, Revised Form No. 16 for Part B (Annexure) and Form No. 24Q Annexure-II

MINISTRY OF FINA ...

Income Tax due dates : extension of various limitation dates – Notification no. 10/2021 in S.O. 966 (E) dated 27/02/2021

Income Tax due dates : extension of various limitation dates – Notification no. 10/2021 in S.O. 966 (E) dated 27/02/2021

Date for passing of assessme ...