Tag: Income Tax

Rationalisation of Tax free Income on Provident Funds: IRTSA writes to Finance Minister

Rationalisation of Tax free Income on Provident Funds: IRTSA writes to Finance Minister

INDIAN RAILWAYS TECHNICAL SUPERVISORS ASSOCIATION

(Estd. 196 ...

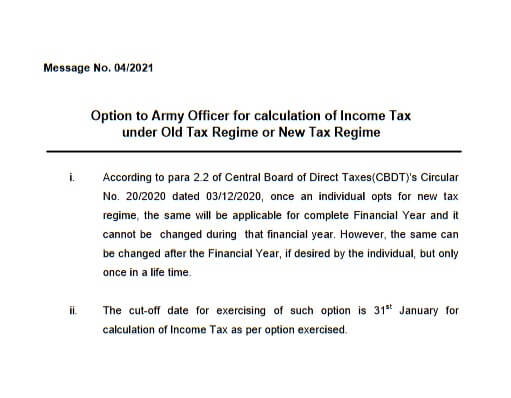

Option for calculation of Income Tax under Old Tax Regime or New Tax Regime : PCDA Message No. 04/2021

Option for calculation of Income Tax under Old Tax Regime or New Tax Regime : PCDA Message No. 04/2021

Message No. 04/2021

Option to Army Office ...

PF tax ceiling will be applicable to GPF as well: CBDT chairman

PF tax ceiling will be applicable to GPF as well: CBDT chairman

Budget 2021-22 has rationalised tax-free income on provident fund contribution by hig ...

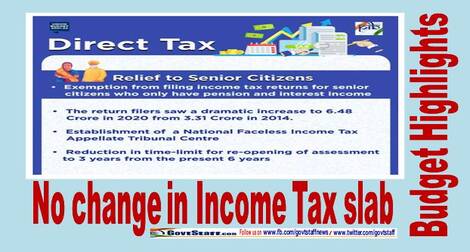

Budget 2021-22: Relief to Senior Citizens – No Change in Income Tax slab

Budget 2021-22: Relief to Senior Citizens - No Change in Income Tax slab

Ministry of Finance

Senior Citizens above 75 years of Age, Having Pensio ...

ईनकम टैक्स रिफंड अभी तक खाते में क्रेडिट नहीं हुआ? जानें मुख्य वजह

ईनकम टैक्स रिफंड अभी तक खाते में क्रेडिट नहीं हुआ? जानें मुख्य वजह

Income tax refund ना आने की 5 बड़ी वजह, विस्तार से पढ़िए कहां हुई चूक

Income T ...

आईटीआर फाइलिंग की अंतिम तिथि फिर से बढ़ाने के सम्बन्ध में वित्त मंत्रालय का स्पष्टीकरण

आईटीआर फाइलिंग की अंतिम तिथि फिर से बढ़ाने के सम्बन्ध में वित्त मंत्रालय का स्पष्टीकरण

आयकर रिटर्न (आईटीआर) फाइलिंग की अन्तिम तिथि 10 जनवरी 202 ...

Income Tax Circular No. 20/2020: TDS and Tax on Salary Section 192 FY 2020-21 & AY 2021-22

TDS and Tax on Salary Section 192 FY 2020-21 AY 2021-22 – CBDT issued Income Tax Circular No. 20/2020 dated 03rd December 2020 which contains provisi ...

Income Tax Return : Instruction for filling ITR-1 SAHAJ

Income Tax Return : Instruction for filling ITR-1 SAHAJ

Instructions for filling ITR-1 SAHAJ

A.Y. 2020-21

General Instructions

These instruction ...

CBDT Circular : Condonation of delay under section 119 (2) (b) of the Income-tax Act, 1961 in filing of Form No. 10 BB for Assessment Year 2016-17 and subsequent years – Reg

CBDT Circular : Condonation of delay under section 119 (2) (b) of the Income-tax Act, 1961 in filing of Form No. 10 BB for Assessment Year 2016-17 and ...

Income-tax Exemption for payment of deemed LTC fare for non-Central Government employees: Finance Ministry News

Income-tax Exemption for payment of deemed LTC fare for non-Central Government employees: Finance Ministry News

Ministry of Finance

Income-tax Exe ...