Important Update for NPS Subscribers—Scheme A (Tier 1) : PFRDA proposed to merge Scheme A with Schemes C and E

फाईल न.: PFRDA/16/3/29/0123/2017-REG-PF-CN:1818

Important Update for NPS Subscribers—Scheme A (Tier 1)

Dear Subscriber,

Thank you for being a valued member of the NPS. We would like to inform you of an important development concerning Scheme A, which you had opted for earlier under Active choice in Tier I.

After a comprehensive review of the scheme’s performance and structure, and keeping your long-term retirement interests in focus, it is proposed by PFRDA to merge Scheme A with Schemes C and E. This step is intended to provide a more stable, efficient, and rewarding investment experience for subscribers.

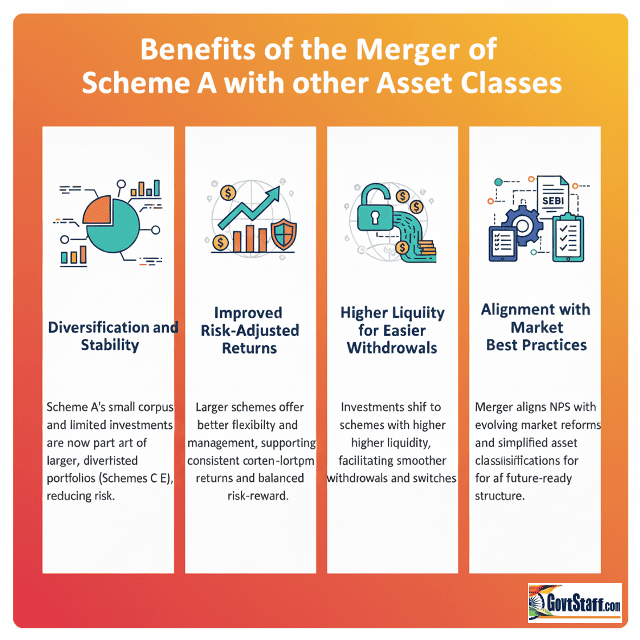

Benefits of the Merger of Scheme A with other Asset Classes

| Objective | Benefits |

| Diversification and Stability |

|

| Improved Risk-Adjusted Returns | Larger schemes offer better flexibility and portfolio management efficiency, which supports more consistent long-term returns and a better balance between risk – reward for retirement investment. |

| Higher Liquidity for Easier Withdrawals |

|

| Alignment with Market Best Practices |

|

The Change Is Made in the best Interest of Subscribers

PFRDA has recently approved significant reforms aimed at modernising the NPS investment framework. These reforms

- Expand the permissible investment universe

- Enhance diversification and

- Promote a more efficient scheme architecture to help subscribers build stronger and more resilient retirement wealth.

As Formalization, Financialization, and Pensionalization (FFP) of the Nation continue to influence the financial aspirations of every Indian citizen, long-term pension (patient) capital is expected to grow and integrate more deeply with India’s growth story. FFP remains a key pillar in strengthening long-term old age Income security.

Merging Scheme, A with Schemes C and E ensures that your NPS contributions are invested in larger, diversified, and more liquid portfolios, enabling smoother management and more efficient long-term growth.

Thank you for your continued trust in NPS.

| Those NPS Subscribers who had opted for Scheme A in Tier I (Active Choice) can exercise additional choice of switching their wealth from Scheme A into any other asset classes of their choice without any additional cost till 25th Dec 2025 as per applicable guidelines. |

COMMENTS