Category: Finmin Order

Central Government Account (Receipts and Payments) Rules, 2022 – CGA OM dated 06.09.2022

Central Government Account (Receipts and Payments) Rules, 2022 - CGA OM dated 06.09.2022

F. No, TA-2-03002(01)/1/2020-TA-H/(E-2106)/ 302

Government ...

Intensive Examination of Public Procurement Contracts 2022 – Revised Guidelines vide CVC Circular No.19/09/22

Intensive Examination of Public Procurement Contracts 2022 - Revised Guidelines vide CVC Circular No.19/09/22

CENTRAL VIGILANCE COMMISSION

Satarkt ...

Use of Staff Car in Central Government Offices – Compendium of Instruction by Department of Expenditure

Use of Staff Car in Central Government Offices - Compendium of Instruction by Department of Expenditure

No. 18(23)/E.Coord-2021

Government of India

...

Acceptance of electronic Bank Guarantee (e-BG) – Amendment in General Financial Rules (GFR), 2017

Acceptance of electronic Bank Guarantee (e-BG) - Amendment in General Financial Rules (GFR), 2017

No.F.1/4/2022-PPD

Government of India

Ministry of ...

General Financial Rules, 2017 – Compilation of amendments upto 31.07.2022

General Financial Rules, 2017 – Compilation of amendments upto 31.07.2022

Ch.-1 – INTRODUCTION

Rule 1 Short Title and Commencement: These rules m ...

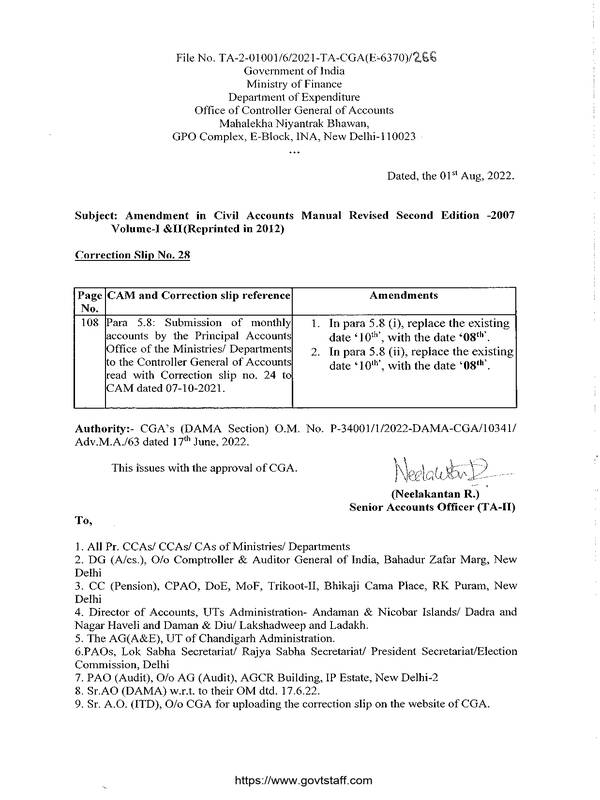

Correction Slip No. 28 : Amendment in Civil Accounts Manual Revised Second Edition -2007 Volume-I &II (Reprinted in 2012)

Correction Slip No. 28 : Amendment in Civil Accounts Manual Revised Second Edition -2007 Volume-I & II (Reprinted in 2012)

File No. TA-2-01001/6/ ...

Performance Audit of National Pension System – CGA seeks information/ status update on Action Taken Notes (ATN)

Performance Audit of National Pension System - CGA seeks information/ status update on Action Taken Notes (ATN)

No. TA-3-20112/2020-TA-III/cs 42611/8 ...

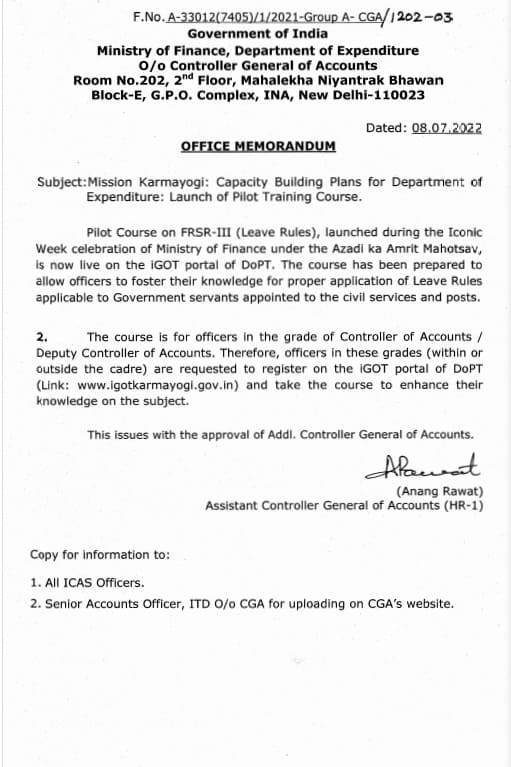

Mission Karmayogi: Launch of Pilot Training Course on Leave Rules – Capacity Building Plans for Department of Expenditure

Mission Karmayogi: Launch of Pilot Training Course on Leave Rules - Capacity Building Plans for Department of Expenditure

F.No. A-33042(7405)/1/2021- ...

Methodology of fixation of pay on promotion to SO(A/c) AAO on account of passing SAS Part-II/Appendix-II Examinations which involves Special Allowance

Methodology of fixation of pay on promotion to SO(A/c) AAO on account of passing SAS Part-II/Appendix-II Examinations which involves Special Allowance ...

Small Savings Schemes Interest Rate for the 2nd Qtr of FY 2022-23 from 01.07.2022 to 30.09.2022 remains unchanged

Small Savings Schemes Interest Rate for the 2nd Qtr of FY 2022-23 from 01.07.2022 to 30.09.2022 remains unchanged

F.No.1/4/2019-NS

Government of Ind ...