Category: Finmin Order

Scrapping policy for condemned vehicle of Ministries/ Departments of Govt. of India – Finmin O.M. dated 09.12.2022

Scrapping policy for condemned vehicle of Ministries/ Departments of Govt. of India - Finmin O.M. dated 09.12.2022

No.01(18)/2022 - E. II (A)

Minist ...

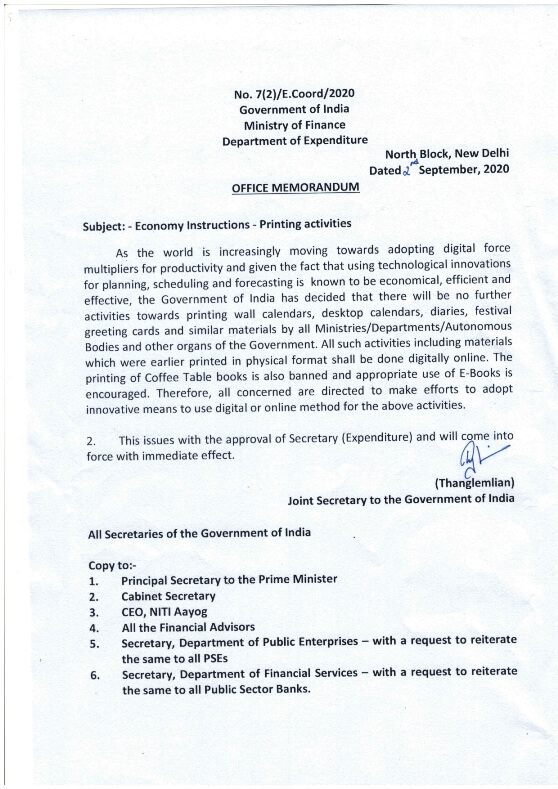

Printing of calendar – Finance Ministry lifted ban on printing of calendars by Ministries/Departments/Autonomous Bodies

Printing of calendar - Finance Ministry lifted ban on printing of calendars by Ministries/Departments/Autonomous Bodies

No. 7(2)/E.Coord./2020

Gover ...

Irregularities in payment of pension and dearness relief by banks in r/o IDA pensioners of FCI – DoE O.M. dated 10.11.2022

Irregularities in payment of pension and dearness relief by banks in r/o IDA pensioners of FCI - DoE O.M. dated 10.11.2022

GOVERNMENT OF INDIA

MIN ...

Non-Productivity Linked Bonus (ad-hoc bonus) to CG Employees for the Financial Year 2021-22 – Finmin O.M dated 06.10.2022

Non-Productivity Linked Bonus (ad-hoc bonus) to CG Employees for the Financial Year 2021-22 - Finmin O.M dated 06.10.2022

No.7/24/2007/ E III ( ...

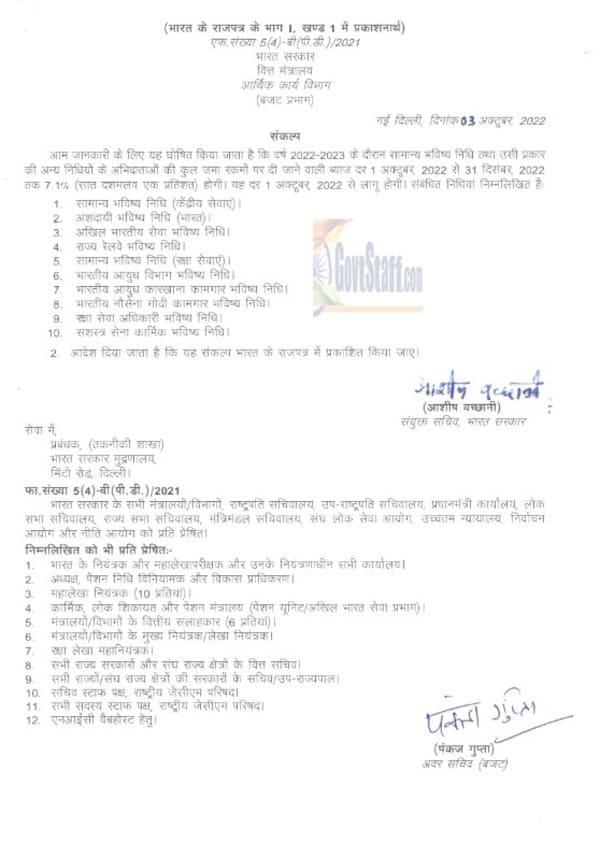

GPF Interest rates @ 7.1% for Q3 of FY 2022-2023 from 1st October, 2022 to 31st December 2022

GPF Interest rates @ 7.1% for Q3 of FY 2022-2023 from 1st October, 2022 to 31st December 2022

(TO BE PUBLISHED IN PART I SECTION 1 OF GAZETTE OF IND ...

Representation from government servants on service matters – CGA O.M. dated 03.10.2022

Representation from government servants on service matters - CGA O.M. dated 03.10.2022

No.A-65061/5/ 2020-Group A- CGA-Part(1)/(3617)/2059

Governmen ...

Small Savings Schemes Interest Rate for the 3rd Qtr of FY 2022-23 from 01.10.2022 to 31.12.2022 – Finmin

Small Savings Schemes Interest Rate for the 3rd Qtr of FY 2022-23 from 01.10.2022 to 31.12.2022 - Finmin

F.No.1/4/2019-NS

Government of India

Minis ...

Push Button Procurement for small value procurements purely on experimental basis for one year from date of launch by GeM

Push Button Procurement for small value procurements purely on experimental basis for one year from date of launch by GeM

Government of India

Minist ...

Grant of Transport Allowance at double the normal rates to persons with disabilities – Compendium of Instruction by Finmin

Grant of Transport Allowance at double the normal rates to persons with disabilities - Compendium of Instruction by Finmin

No.21/1/2018-E.IIB

Gover ...

Admissibility to travel by Tejas Express Trains on Official Tour सरकारी दौरे पर तेजस एक्सप्रेस रेलगाड़ी द्वारा यात्रा की स्वीकार्यता – Finmin O.M dated 12.09.2022

Admissibility to travel by Tejas Express Trains on Official Tour सरकारी दौरे पर तेजस एक्सप्रेस रेलगाड़ी द्वारा यात्रा की स्वीकार्यता - Finmin O.M date ...