Category: Income Tax

Rule 12CB of IT Act 1962 – Income-tax (18th Amendment) Rules, 2020: Statement of income paid or credited by an investment fund to its unit holder

Rule 12CB of IT Act 1962 – Income-tax (18th Amendment) Rules, 2020: Statement of income paid or credited by an investment fund to its unit holder

MIN ...

Clarification in relation to notification issued under clause (v): Section 194N of the Income-tax Act, 1961

Clarification in relation to notification issued under clause (v): Section 194N of the Income-tax Act, 1961

Circular no. 14/2020

F.No. 370142/27/202 ...

New Form 26AS: Faceless hand-holding for the honest Taxpayers/ नया फॉर्म 26एएस: ईमानदार करदाताओं का ‘फेसलेस मददगार’

New Form 26AS: Faceless hand-holding for the honest Taxpayers/ नया फॉर्म 26एएस: ईमानदार करदाताओं का ‘फेसलेस मददगार’

पत्र सूचना कार्यालय / Pre ...

CBDT Order: Processing of returns with refund claims under section 143(1) of the Income-tax Act,1961 beyond the prescribed time limits in non-scrutiny cases-regd.

CBDT Order: Processing of returns with refund claims under section 143(1) of the Income-tax Act,1961 beyond the prescribed time limits in non-scrutiny ...

Income Tax: Format of Self Declaration for Option for Deduction of Tax during the Financial Year 2020-21

Income Tax: Format of Self Declaration for Option for Deduction of Tax during the Financial Year 2020-21 (Assessment Year: 2021-22)

Office of the Pri ...

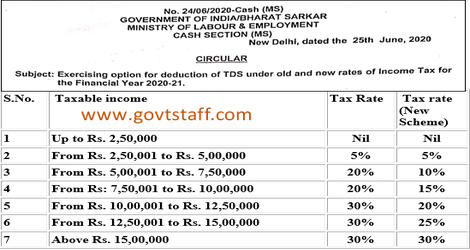

Exercising option for deduction of TDS under old and new rates of Income Tax for F.Y. 2020-21 – Ministry of Labour Circular

Exercising option for deduction of TDS under old and new rates of Income Tax for F.Y. 2020-21 - Ministry of Labour Circular

No. 24/06/2020-C ...