Category: Income Tax

Income Tax Circular No. 20/2020: TDS and Tax on Salary Section 192 FY 2020-21 & AY 2021-22

TDS and Tax on Salary Section 192 FY 2020-21 AY 2021-22 – CBDT issued Income Tax Circular No. 20/2020 dated 03rd December 2020 which contains provisi ...

Income Tax Return : Instruction for filling ITR-1 SAHAJ

Income Tax Return : Instruction for filling ITR-1 SAHAJ

Instructions for filling ITR-1 SAHAJ

A.Y. 2020-21

General Instructions

These instruction ...

CBDT Circular : Condonation of delay under section 119 (2) (b) of the Income-tax Act, 1961 in filing of Form No. 10 BB for Assessment Year 2016-17 and subsequent years – Reg

CBDT Circular : Condonation of delay under section 119 (2) (b) of the Income-tax Act, 1961 in filing of Form No. 10 BB for Assessment Year 2016-17 and ...

Income-tax Exemption for payment of deemed LTC fare for non-Central Government employees: Finance Ministry News

Income-tax Exemption for payment of deemed LTC fare for non-Central Government employees: Finance Ministry News

Ministry of Finance

Income-tax Exe ...

Finmin : Extension of due date of furnishing of Income Tax Returns and Audit Reports – reg./ आयकर रिटर्न और लेखा परीक्षण रिपोर्ट दाखिल करने की अंतिम तिथि को आगे बढ़ाया गया

Extension of due date of furnishing of Income Tax Returns and Audit Reports - reg. / आयकर रिटर्न और लेखा परीक्षण रिपोर्ट दाखिल करने की अंतिम तिथि को आ ...

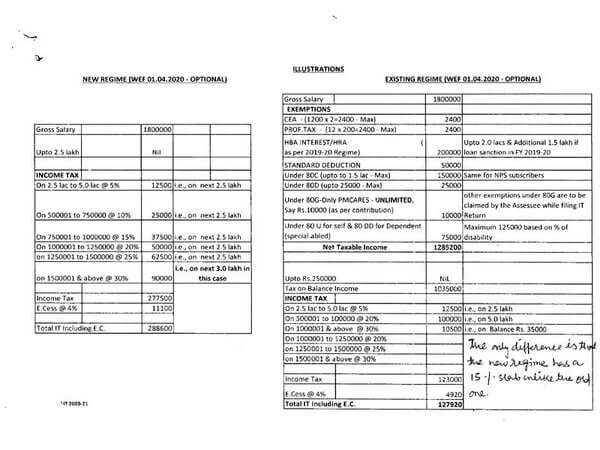

Income Tax: Exercise of Options for choosing Old and New regimes of Income Tax during F.Y. 2020-21

Income Tax: Exercise of Options for choosing Old and New regimes of Income Tax during F.Y. 2020-21

कार्यात्रय रक्षा लेखा नियंत्रक :

OFFICE OF THE CO ...

Income Tax: Extension of deadlines for filing Returns and other related compliances

Income Tax: Extension of deadlines for filing Returns and other related compliances

Amidst the ongoing humanitarian and economic steps to address the ...

Prime Minister Narendra Modi launches platform for “Transparent Taxation – Honouring the Honest”/ प्रधानमंत्री श्री नरेन्द्र मोदी ने “पारदर्शी कराधान – ईमानदार का सम्मान” नाम से एक मंच का शुभारंभ किया

Prime Minister Narendra Modi launches platform for “Transparent Taxation - Honouring the Honest”/ प्रधानमंत्री श्री नरेन्द्र मोदी ने “पारदर्शी कराधान ...

Income Tax Return: अब 30 सितंबर तक भर सकेंगे 2018-19 का ITR, पहले इसे 31 जुलाई तक दाखिल करना था, वित्त वर्ष 2019-20 के लिए आयकर रिटर्न भरने की तारीख पहले ही बढ़ा दी गई थी

Income Tax Return: अब 30 सितंबर तक भर सकेंगे 2018-19 का ITR, पहले इसे 31 जुलाई तक दाखिल करना था, वित्त वर्ष 2019-20 के लिए आयकर रिटर्न भरने की तारीख प ...

Income Tax Circular No. 13/2020 : One-time relaxation for AY 2015-16 to 2019-20 which are pending due to non-filing of ITR V form and processing of such returns

Income Tax Circular No. 13/2020 : One-time relaxation for AY 2015-16 to 2019-20 which are pending due to non-filing of ITR V form and processing of s ...