Category: Income Tax

Income Tax deduction on GPF – CDA Guwahati web circulation

Income Tax deduction on GPF - CDA Guwahati web circulation

Through CDA GUWAHATI WEBSITE

रक्षा लेखा नियंत्रक का कार्यालय, गुवाहाटी उदयन विहार, नारंगी ...

Calculation of taxable interest relating to contribution in a provident fund, exceeding specified limit w.e.f F.Y 2021-22

Calculation of taxable interest relating to contribution in a provident fund, exceeding specified limit w.e.f F.Y 2021-22

No. TA-3-07001/7/2021-TA-II ...

Calculation of Income Tax on Interest of GPF – Implementation of CBDT notification regarding

Calculation of Income Tax on Interest of GPF - Implementation of CBDT notification regarding

कार्यालय, रक्षा लेखा नियंत्रक गुवाहाटी, उदयन विहार, ना ...

Guidelines under Clause (10D) Section 10 of the Income Tax Act 1961 – Exemption on the sum received under a life insurance policy : IT Circular No. 2 of 2022

Guidelines under Clause (10D) Section 10 of the Income Tax Act 1961 – Exemption on the sum received under a life insurance policy : IT Circular No. 2 ...

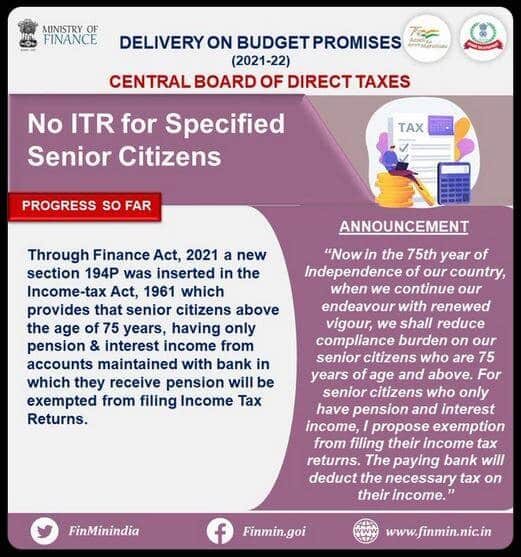

No ITR for Specified Senior Citizens: Through Finance Act 2021 a new section 194P was inserted in IT Act

No ITR for Specified Senior Citizens: Through Finance Act 2021 a new section 194P was inserted in IT Act

ITR for Senior Citizens – To give a much-nee ...

Extension of timelines for filing of Income-tax returns and various reports of audit for the Assessment Year 2021-22 – CBDT Circular No. 01/2022

Extension of timelines for filing of Income-tax returns and various reports of audit for the Assessment Year 2021-22 - CBDT Circular No. 01/2022

Ci ...

Income Tax e-Settlement Scheme, 2021: CBDT Notification No. 129/2021

Income Tax e-Settlement Scheme, 2021: CBDT Notification No. 129/2021

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TAXES)

...

Submission of Income Tax Savings Documents for the Financial Year 2021-2022, Format of Self Declaration and Rent Receipt: DAD

Submission of Income Tax Savings Documents for the Financial Year 2021-2022, Format of Self Declaration and Rent Receipt: DAD

GOVERNMENT OF INDIA

...

Income Tax 2021-22: Tax Rates, Option for Tax Regime, Format for Declaration (old tax regime)

Income Tax 2021-22: Tax Rates, Option for Tax Regime, Format for Declaration (old tax regime)

Directorate General

Central Public Works ...

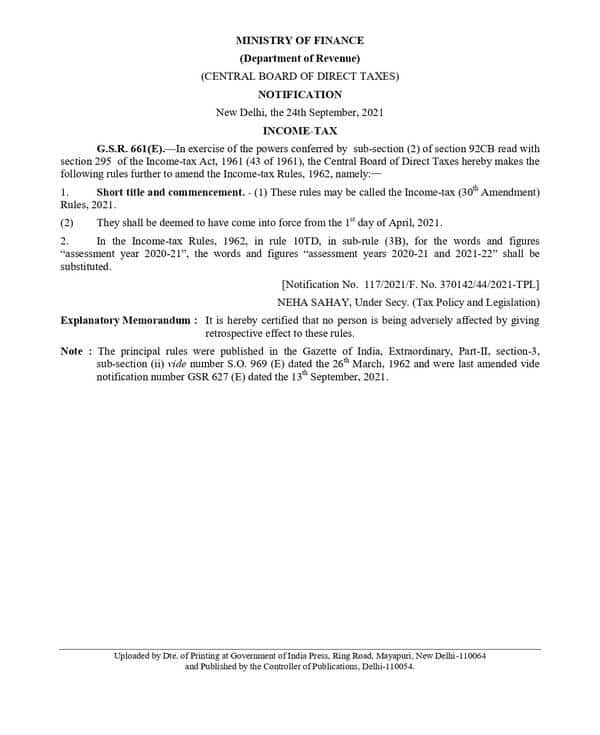

Income Tax (30th Amendment) Rules 2021 – CBDT Notification dated 24-09-2021

Income Tax (30th Amendment) Rules 2021 - CBDT Notification dated 24-09-2021

MINISTRY OF FINANCE

(Department of Revenue)

(CENTRAL BOARD OF DIRECT TA ...