Tag: Income Tax

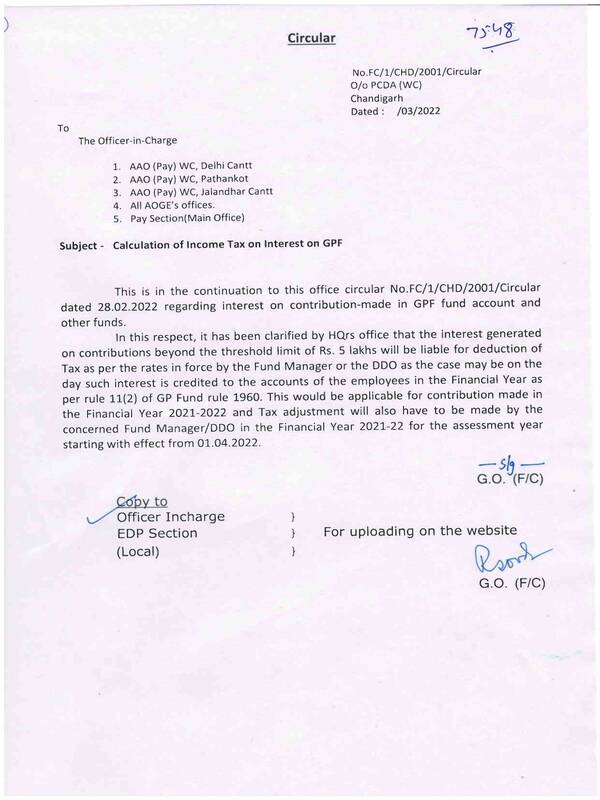

Calculation of Income Tax on Interest on GPF

Calculation of Income Tax on Interest on GPF

7548

Circular

No.FC/1/CHD/2001/Circular

O/o PCDA (WC)

Chandigarh

Dated: /03/2022

To

The Office ...

Calculation of Income Tax on Interest of GPF – Issues raised and clarification by DAD (HQ)

Calculation of Income Tax on Interest of GPF - Issues raised and clarification by DAD (HQ)

रक्षा लेखा विभाग (र.ले.वि.) मुख्यालय

उलान बटार रोड, पालम, ...

Income Tax deduction on GPF – CDA Guwahati web circulation

Income Tax deduction on GPF - CDA Guwahati web circulation

Through CDA GUWAHATI WEBSITE

रक्षा लेखा नियंत्रक का कार्यालय, गुवाहाटी उदयन विहार, नारंगी ...

Amendment in Civil Accounts Manual Revised Second Edition -2007 Volume-I & II regarding Income Tax on Provident Fund

Amendment in Civil Accounts Manual Revised Second Edition -2007 Volume-I & II regarding Income Tax on Provident Fund

F. No. TA-2-01001/1/2022-TA- ...

Calculation of taxable interest relating to contribution in a provident fund, exceeding specified limit w.e.f F.Y 2021-22

Calculation of taxable interest relating to contribution in a provident fund, exceeding specified limit w.e.f F.Y 2021-22

No. TA-3-07001/7/2021-TA-II ...

Calculation of Income Tax on Interest of GPF – Implementation of CBDT notification regarding

Calculation of Income Tax on Interest of GPF - Implementation of CBDT notification regarding

कार्यालय, रक्षा लेखा नियंत्रक गुवाहाटी, उदयन विहार, ना ...

Calculation of Income Tax on Interest of GPF on contribution above Rs. 5 Lakhs

Calculation of Income Tax on Interest of GPF on contribution above Rs. 5 Lakhs

Defence Accounts Department (DAD) Headquarters

Ulan Batar Road, Palam ...

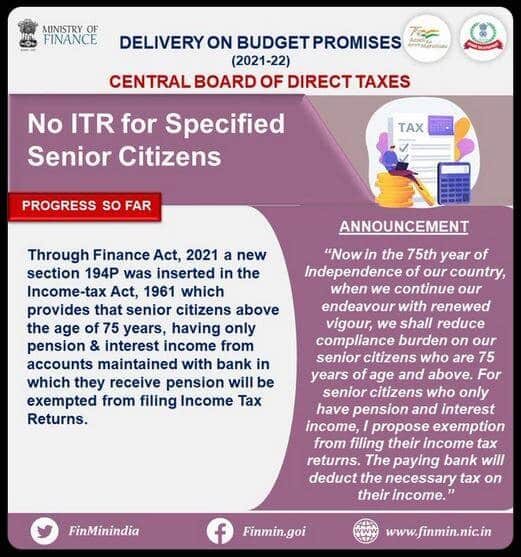

No ITR for Specified Senior Citizens: Through Finance Act 2021 a new section 194P was inserted in IT Act

No ITR for Specified Senior Citizens: Through Finance Act 2021 a new section 194P was inserted in IT Act

ITR for Senior Citizens – To give a much-nee ...

Extension of timelines for filing of Income-tax returns and various reports of audit for the Assessment Year 2021-22 – CBDT Circular No. 01/2022

Extension of timelines for filing of Income-tax returns and various reports of audit for the Assessment Year 2021-22 - CBDT Circular No. 01/2022

Ci ...

One-time relaxation for verification of all income tax-returns e-filed for the Assessment Year 2020-21 which are pending for verification and processing of such returns – Circular No. 21/2021

One-time relaxation for verification of all income tax-returns e-filed for the Assessment Year 2020-21 which are pending for verification and processi ...