Tag: Income Tax

Calculation and deduction of taxable interest relating to contribution in a provident fund exceeding specified limit – Illustrations, CBDT Notification

Calculation and deduction of taxable interest relating to contribution in a provident fund exceeding specified limit - Illustrations, CBDT Notificatio ...

Clarification with respect to relaxation of provisions of rule 114AAA of Income-tax Rules, 1962 prescribing the manner of making Permanent Account Number (PAN) inoperative – CBDT Circular No. 7 of 2022

Clarification with respect to relaxation of provisions of rule 114AAA of Income-tax Rules, 1962 prescribing the manner of making Permanent Account Num ...

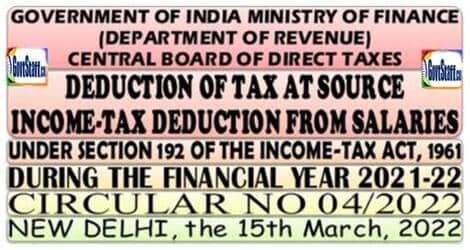

Circular No. 4/2022 – Deduction of Tax at Source – Income-tax Deduction from Salaries under section 192 of the Income-tax Act 1961

Circular No. 4/2022 - Deduction of Tax at Source - Income-tax Deduction from Salaries under section 192 of the Income-tax Act, 1961

CIRCULAR NO: 0 ...

Rationalisation of Income Tax Slabs : Those in the higher income brackets contribute more to the Nation’s development

Rationalisation of Income Tax Slabs : Those in the higher income brackets contribute more to the Nation’s development.

GOVERNMENT OF INDIA

MINISTRY ...

Violation of faceless assessment procedure by IT officials आयकर अधिकारियों द्वारा फेसलेस मूल्यांकन प्रक्रिया का उल्लंघन

Violation of faceless assessment procedure by IT officials आयकर अधिकारियों द्वारा फेसलेस मूल्यांकन प्रक्रिया का उल्लंघन

GOVERNMENT OF INDIA

MINIST ...

Income-Tax Deduction from Salaries during the Financial Year 021-22: Circular No. 04/2022

Income-Tax Deduction from Salaries during the Financial Year 021-22: Circular No. 04/2022

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF ...

Faceless Penalty Scheme: Defining the scope of Penalty to be assigned to the Faceless Penalty Scheme, 2021

Faceless Penalty Scheme: Defining the scope of Penalty to be assigned to the Faceless Penalty Scheme, 2021

F No. 187/4/2021-ITA-I

Government of In ...

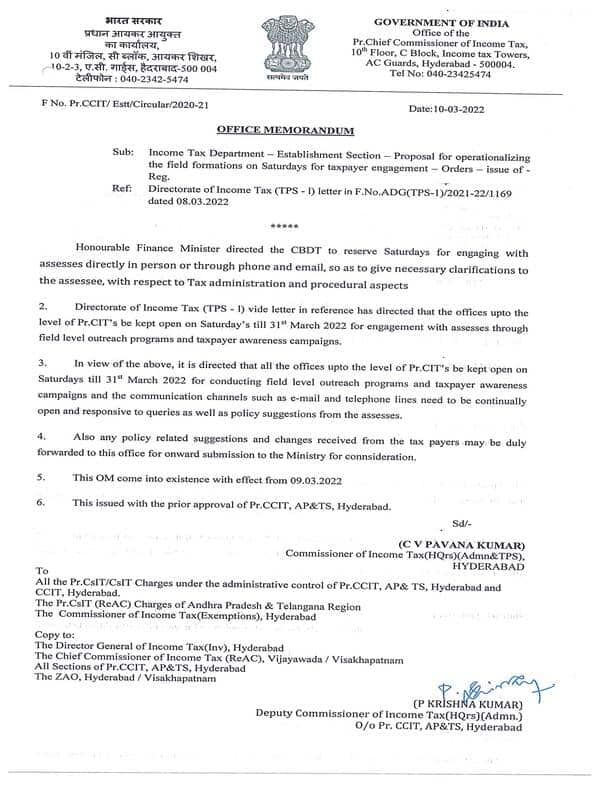

Proposal for Operationalizing the field formations on Saturdays for taxpayer engagement — Income Tax O.M.

Proposal for Operationalizing the field formations on Saturdays for taxpayer engagement — Income Tax O.M.

भारत सरकार GOVERNMENT OF INDIA

प्रधान कार् ...

Implementation of e-Office in the Income Tax Department — dry run on eOffice application

Implementation of e-Office in the Income Tax Department — dry run on eOffice application

Office of the Pr. Chief Commissioner of Income Tax

Andhra ...

Income Tax payable on the contribution in a PF account exceeding Rs. 5 lakh per annum w.e.f financial year 2021-22: CGA O.M.

Income Tax payable on the contribution in a PF account exceeding Rs. 5 lakh per annum w.e.f financial year 2021-22: CGA O.M.

TA-3-07001/7/2021-TA-III ...