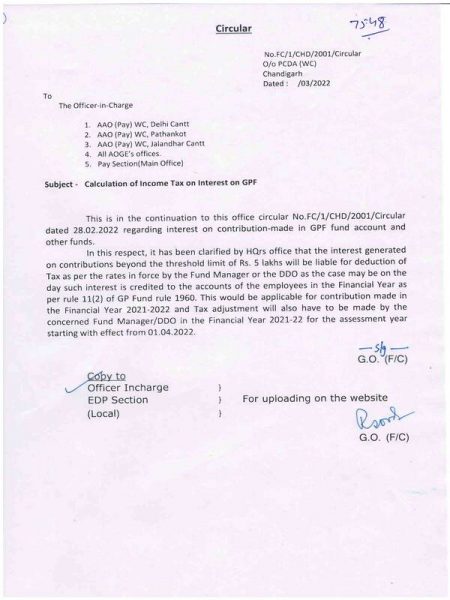

Calculation of Income Tax on Interest on GPF

7548

Circular

No.FC/1/CHD/2001/Circular

O/o PCDA (WC)

Chandigarh

Dated: /03/2022

To

The Officer-in-Charge

-

- AAO (Pay) WC, Delhi Cantt

- AAO (Pay) WC, Pathankot

- AAO (Pay) WC, Jalandhar Cantt

- All AOGE’s offices.

- Pay Section(Main Office)

Subject – Calculation of Income Tax on Interest on GPF

This is in the continuation to this office circular No.FC/1/CHD/2001/ Circular dated 28.02.2022 regarding interest on contribution-made in GPF fund account and other funds.

In this respect, it has been clarified by HQrs office that the interest generated on contributions beyond the threshold limit of Rs. 5 lakhs will be liable for deduction of Tax as per the rates in force by the Fund Manager or the DDO as the case may be on the day such interest is credited to the accounts of the employees in the Financial Year as per rule 11(2) of GP Fund rule 1960. This would be applicable for contribution made in the Financial Year 2021-2022 and Tax adjustment will also have to be made by the concerned Fund Manager/DDO in the Financial Year 2021-22 for the assessment year starting with effect from 01.04.2022.

G.O.(F/C)

Copy to

Officer Incharge }

EDP Section } For uploading on the website

(Local) }

G.O. (F/C)

Calculation of Income Tax on Interest on GPF

https://pcdawc.gov.in/images/pdf/circulars/fundCell/7548_calculation.pdf

COMMENTS