Tag: Salary

Composite Salary Account Package for Central Government Employees in association with Public Sector Banks – Unified salary account framework provides a one-stop financial solution: Ministry of Finance

Composite Salary Account Package for Central Government Employees in association with Public Sector Banks – Unified salary account framework provides ...

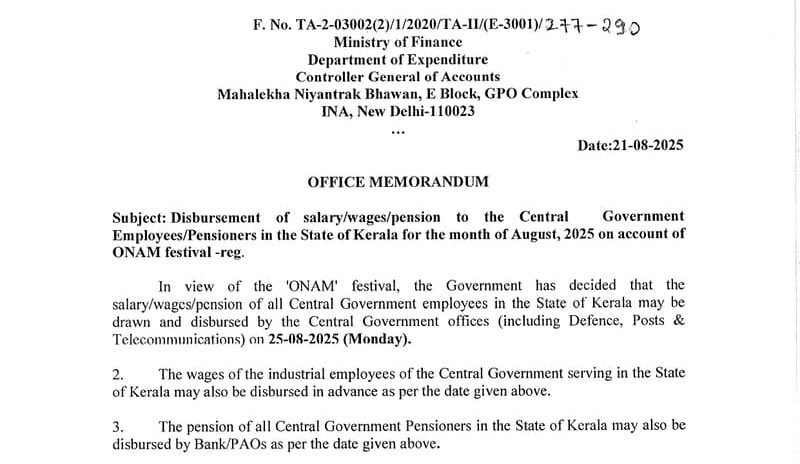

Disbursement of salary/wages/pension for the month of August, 2025 on account of ONAM festival on 25.08.2025 to the Central Government Employees/Pensioners in Kerala : CGA, FinMin O.M. dated 21.08.2025

Disbursement of salary/wages/pension for the month of August, 2025 on account of ONAM festival on 25.08.2025 to the Central Government Employees/Pensi ...

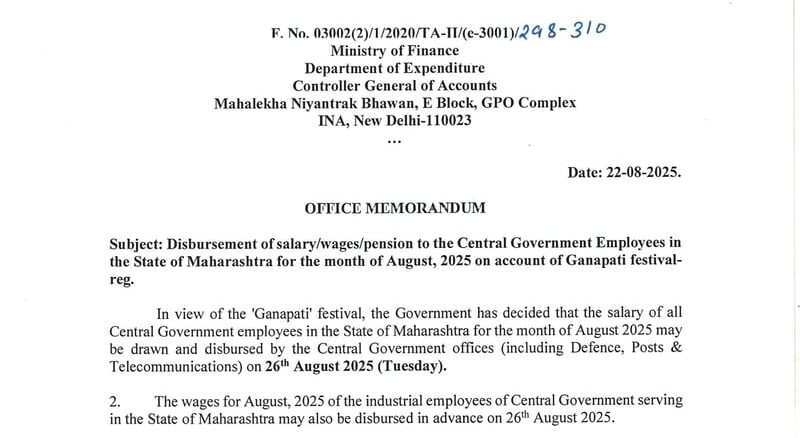

Disbursement of Salary for the month of August 2025 to CG Employees posted in Maharashtra on account of Ganapati festival – CGA O.M F. No. 03002(2)/1/2020/TA-IT/(e-3001)/248- 310 dated 22-08-2025

Disbursement of Salary for the month of August 2025 to CG Employees posted in Maharashtra on account of Ganapati festival - CGA O.M F. No. 03002(2)/1/ ...

Minimum Salary for Nurses and Healthcare Workers: Recommendations of Experts Committee – Rajyasabha Q and A

Minimum Salary for Nurses and Healthcare Workers: Recommendations of Experts Committee - Rajyasabha Q and A

GOVERNMENT OF INDIA

MINISTRY OF HEALTH A ...

Payment of Salary/wages/pension on 25.08.2023 on account of ONAM festival and on 27.09.2023 on account of Ganapati Festival to the Postal Employees posted in Kerala and Maharashtra respectively

Payment of Salary/wages/pension on 25.08.2023 on account of ONAM festival and on 27.09.2023 on account of Ganapati Festival to the Postal Employees po ...

Disbursement of salary/wages/pension to the CG Employees/Pensioners in Kerala and Maharashtra on 25.08.2023 and 27.09.2023 on account of ONAM and Ganpati Festival respectively

Disbursement of salary/wages/pension to the CG Employees/Pensioners in Kerala and Maharashtra on 25.08.2023 and 27.09.2023 on account of ONAM and Gan ...

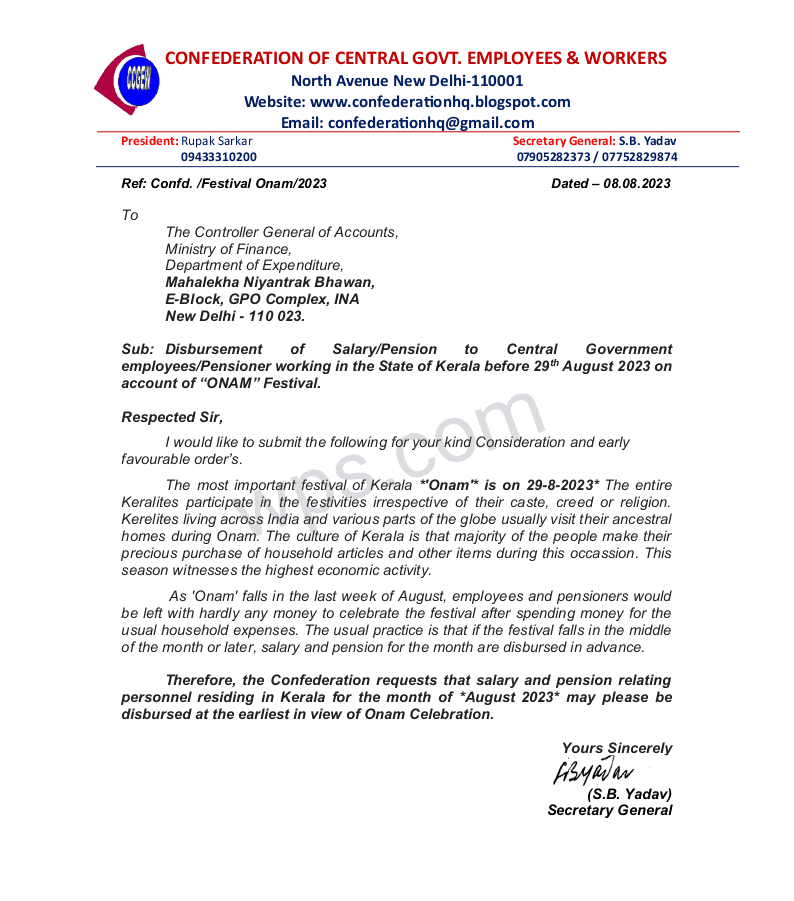

Disbursement of Salary/Pension to Central Government employees/Pensioner working in the State of Kerala before 29th August 2023 on account of “ONAM” Festival

Disbursement of Salary/Pension to Central Government employees/Pensioner working in the State of Kerala before 29th August 2023 on account of “ONAM” F ...

Earmarking of at least 2.5% of Salary Budget for training and capacity building: DoP&T O.M dated 07.03.2023

Earmarking of at least 2.5% of Salary Budget for training and capacity building: DoP&T O.M dated 07.03.2023

No. T1601 21 202e-TFA

Government of ...

Salary of Nurses / नर्सों को वेतन : Loksabha Q and A

Salary of Nurses / नर्सों को वेतन : Loksabha Q and A

GOVERNMENT OF INDIA

MINISTRY OF HEALTH AND FAMILY WELFARE

DEPARTMENT OF HEALTH AND FAMILY WELF ...

8th Pay Commission पर आया बड़ा अपडेट, केंद्रीय कर्मचारियों की सैलरी में होगी बंपर उछाल!

8th Pay Commission पर आया बड़ा अपडेट, केंद्रीय कर्मचारियों की सैलरी में होगी बंपर उछाल!

Fitment Factor: 2024 के चुनाव के बाद नई सरकार के गठन के बाद क ...