Special Cash Package equivalent in lieu of Leave Travel Concession – 3rd FAQ by Finmin dated 25-11-2020

No.12(2)/2020/E.ILA

Government of India

Ministry of Finance

Department of Expenditure

*****

North Block, New Delhi

Dated 25th November, 2020

OFFICE MEMORANDUM

Subject:- Clarification regarding queries being received in respect of Special Cash Package equivalent in lieu of Leave Travel Concession Fare for Central Government Employees during the block 2018-21 (FAQ No.3)

The undersigned is directed to say that this Department has been receiving a number of queries relating to Special Package equivalent in lieu of Leave Travel Concession Fare for Central Government Employees during the block 2018-21 announced by the Government on 12th October, 2020. Two sets of frequently asked questions have already been clarified vide this Department’s OM of even no. dated 20″ October, 2020 and 10th November, 2020 are available on this Department’s website viz. doe. gov.in.

2. A further set of frequently asked questions have been clarified and is attached herewith at Annexure below.

3. This issues with the approval of Secretary (Exp.).

(S. Naganathan)

Deputy Secretary (E.II.A)

All Ministries/Departments of the Government of India

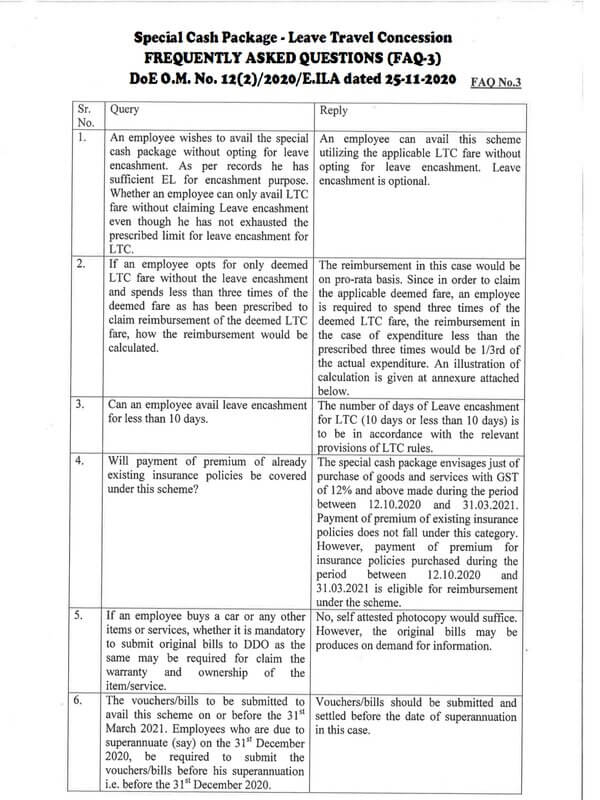

FAQ No.3

| Sr. No. | Query | Reply |

| 1. | An employee wishes to avail the special cash package without opting for leave encashment. As per records he has sufficient EL for encashment purpose. Whether an employee can only avail LTC fare without claiming Leave encashment even though he has not exhausted the prescribed limit for leave encashment for LTC. | An employee can avail this scheme utilizing the applicable LTC fare without opting for leave encashment. Leave encashment 1s optional. |

| 2. | If an employee opts for only deemed LTC fare without the leave encashment and spends less than three times of the deemed fare as has been prescribed to claim reimbursement of the deemed LTC fare, how the reimbursement would be calculated. | The reimbursement in this case would be on pro-rata basis. Since in order to claim the applicable deemed fare, an employee is required to spend three times of the deemed LTC fare, the reimbursement in the case of expenditure less than the prescribed three times would be 1/3rd of the actual expenditure. An illustration of calculation is given at annexure attached below. |

| 3. | Can an employee avail leave encashment for less than 10 days. | The number of days of Leave encashment for LTC (10 days or less than 10 days) is to be in accordance with the relevant provisions of LTC rules. |

| 4. |

Will payment of premium of already existing insurance policies be covered under this scheme?

|

The special cash package envisages just of purchase of goods and services with GST of 12% and above made during the period between 12.10.2020 and 31.03.2021. Payment of premium of existing insurance policies does not fall under this category. However, payment of premium for insurance policies purchased during the period between 12.10.2020 and 31.03.2021 1s eligible for reimbursement under the scheme. |

| 5. | If an employee buys a car or any other items or services, whether it is mandatory to submit original bills to DDO as the same may be required for claim the watranty and ownership of the item/service. | No, self attested photocopy would suffice. However, the original bills may be produces on demand for information. |

| 6. | The vouchers/bills to be submitted to avail this scheme on or before the 31st March 2021. Employees who are due to superannuate (say) on the 31st December 2020, be required to submit the vouchers/bills before his superannuation i.e. before the 31st December 2020. | Vouchers/bills should be submitted and settled before the date of superannuation in this case. |

Annexure-_.

Example (1) (without Leave Encashment)

Claiming for family of 4 eligible for economy class air travel.

Fare Value : Rs.20,000 x 4 = Rs.80,000

Amount to be spent for full cash benefit = Rs.80,000 x 3* = Rs.2,40,000

* 3 times of notional airfare (80,000 x 3=2,40,000)

Cash benefit = Amount Spent X deemed LTC Fare (80,000 in this case)

Amount to be spent for full cash benefit

Thus, if an employee spends say Rs.2,40,000 or above, he will be allowed cash amount of Rs.80,000. However, if the employee spends less than Rs.2,40,000, say 1,80,000 then he may be allowed cash amount in the same proportion as illustrated above which comes out Rs.60,000 in this case.

[1,80,000 X 80,000 = 60,000].

2,40,000

Example (2) (without Leave Encashment)

Claiming for family of 4 eligible for Train travel.

Fare Value : Rs.6,000x 4 = Rs.24,000

Amount to be spent for full cash benefit = Rs.24,000 x 3* = Rs.72,000

Cash benefit = Amount Spent X deemed LTC Fare (24,000 in this case)

Amount to be spent for full cash benefit

* 3 times of notional train fare (24,000 x 3=72,000)

Thus, if an employee spends Rs.72,000 or above, he will be allowed cash amount of Rs.24,000. However, if the employee spends less than Rs.72,000 say 48,000 then he may be allowed cash amount in the same proportion as illustrated above which comes out Rs.16,000 in this case.

[48,000 X 24,000 = 16,000].

72,000

Source: FINMIN

COMMENTS