Tag: DoE

Use of Staff Car in Central Government Offices – Compendium of Instruction by Department of Expenditure

Use of Staff Car in Central Government Offices - Compendium of Instruction by Department of Expenditure

No. 18(23)/E.Coord-2021

Government of India

...

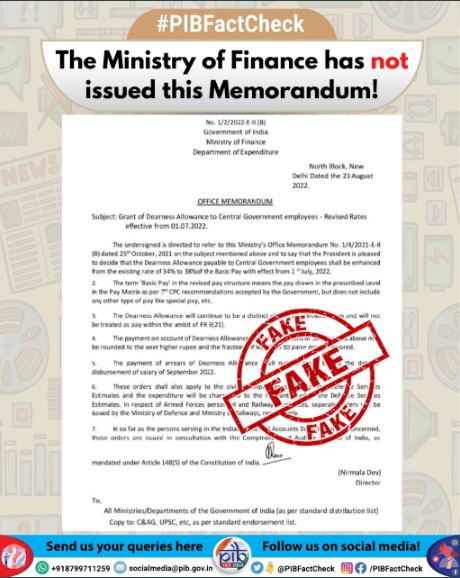

Dearness Allowance @ 38% w.e.f. 01.07.2022 – Ministry of Finance has not issued any Office Memorandum : PIB Fact Check Report

Dearness Allowance @ 38% w.e.f. 01.07.2022 - Ministry of Finance has not issued any such Office Memorandum : PIB Fact Check Report

A Fake order circu ...

General Financial Rules, 2017 – Compilation of amendments upto 31.07.2022

General Financial Rules, 2017 – Compilation of amendments upto 31.07.2022

Ch.-1 – INTRODUCTION

Rule 1 Short Title and Commencement: These rules m ...

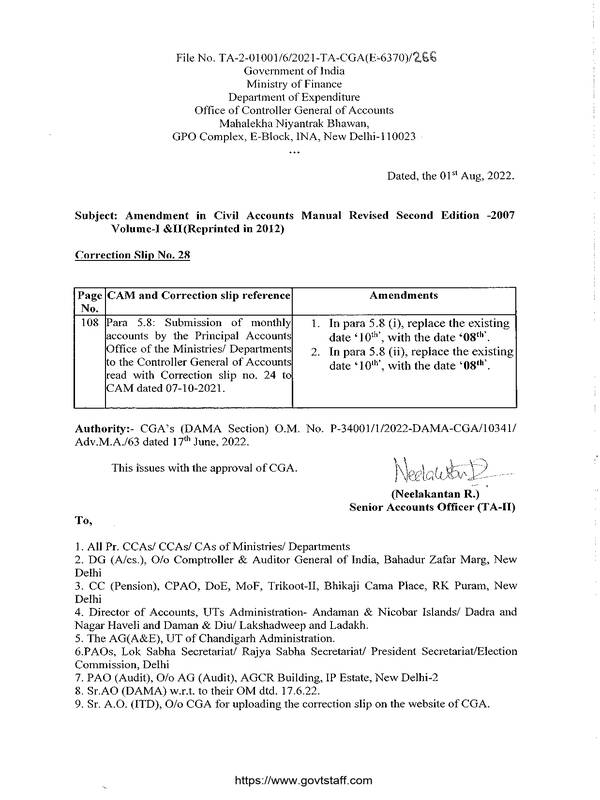

Correction Slip No. 28 : Amendment in Civil Accounts Manual Revised Second Edition -2007 Volume-I &II (Reprinted in 2012)

Correction Slip No. 28 : Amendment in Civil Accounts Manual Revised Second Edition -2007 Volume-I & II (Reprinted in 2012)

File No. TA-2-01001/6/ ...

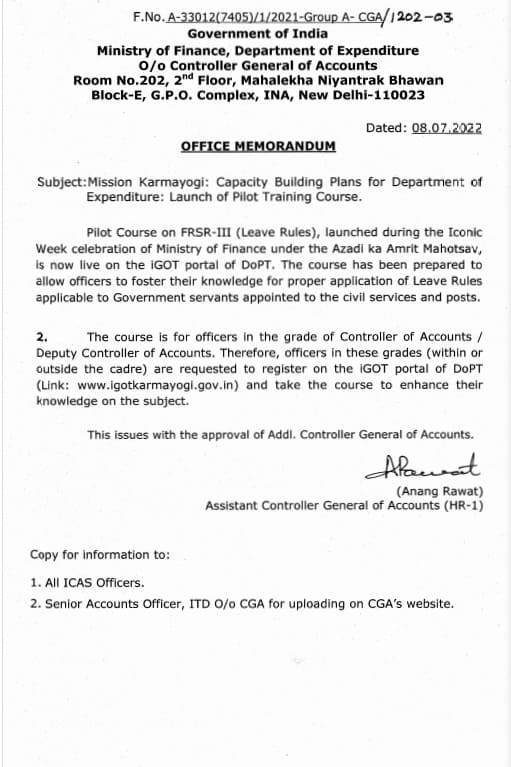

Mission Karmayogi: Launch of Pilot Training Course on Leave Rules – Capacity Building Plans for Department of Expenditure

Mission Karmayogi: Launch of Pilot Training Course on Leave Rules - Capacity Building Plans for Department of Expenditure

F.No. A-33042(7405)/1/2021- ...

Methodology of fixation of pay on promotion to SO(A/c) AAO on account of passing SAS Part-II/Appendix-II Examinations which involves Special Allowance

Methodology of fixation of pay on promotion to SO(A/c) AAO on account of passing SAS Part-II/Appendix-II Examinations which involves Special Allowance ...

An official can also purchase an iPad by availing Computer Advance – Department of Post order dated 27.06.2022

An official can also purchase an iPad by availing Computer Advance - Department of Post order dated 27.06.2022

F.No. 19-01/2021-PAP

Ministry of Comm ...

Verification of membership strength of “All India Civil Accounts Gr. ‘B’ Gazetted (AAOs) Association” under Central Civil Service (Recognition of Service Association) Rules, 1993

Verification of membership strength of “All India Civil Accounts Gr. ‘B’ Gazetted (AAOs) Association” under Central Civil Service (Recognition of Serv ...

iPad can also be purchased by the CG employees by availing Computer Advance – Clarification by DoE

iPad can also be purchased by the CG employees by availing Computer Advance - Clarification by DoE

F.No.12(04)/2022-E. IIA

Government of India

Mini ...

7th Pay Commission: Booking of Air Tickets on Government account – Modification of instructions regarding : Finmin OM dated 16.06.2022

7th Pay Commission: Booking of Air Tickets on Government account - Modification of instructions regarding : Finmin OM dated 16.06.2022

No. 19024/03/2 ...