Tag: PFRDA

Financial Information (FI) Types for Balances under National Pension System (NPS): PFRDA

Financial Information (FI) Types for Balances under National Pension System (NPS) : PFRDA

पेंशन निधि विनियामक एवं विकास प्राधिकरण

PENSION FUND REGU ...

Streamlining the implementation of the National Pension System : PFRDA order dated 06.02.2023

Streamlining the implementation of the National Pension System : PFRDA order dated 06.02.2023

PENSION FUND REGULATORY AND DEVELOPMENT AUTHORITY

PERD ...

NPS/APY Functionalities released by CRAs during Quarter III (FY 2022-23) : PFRDA Circular dated 21.02.2023

NPS/APY Functionalities released by CRAs during Quarter III (FY 2022-23) : PFRDA Circular dated 21.02.2023

पेंशन निधि विनियामक एवं विकास प्राधिकरण

P ...

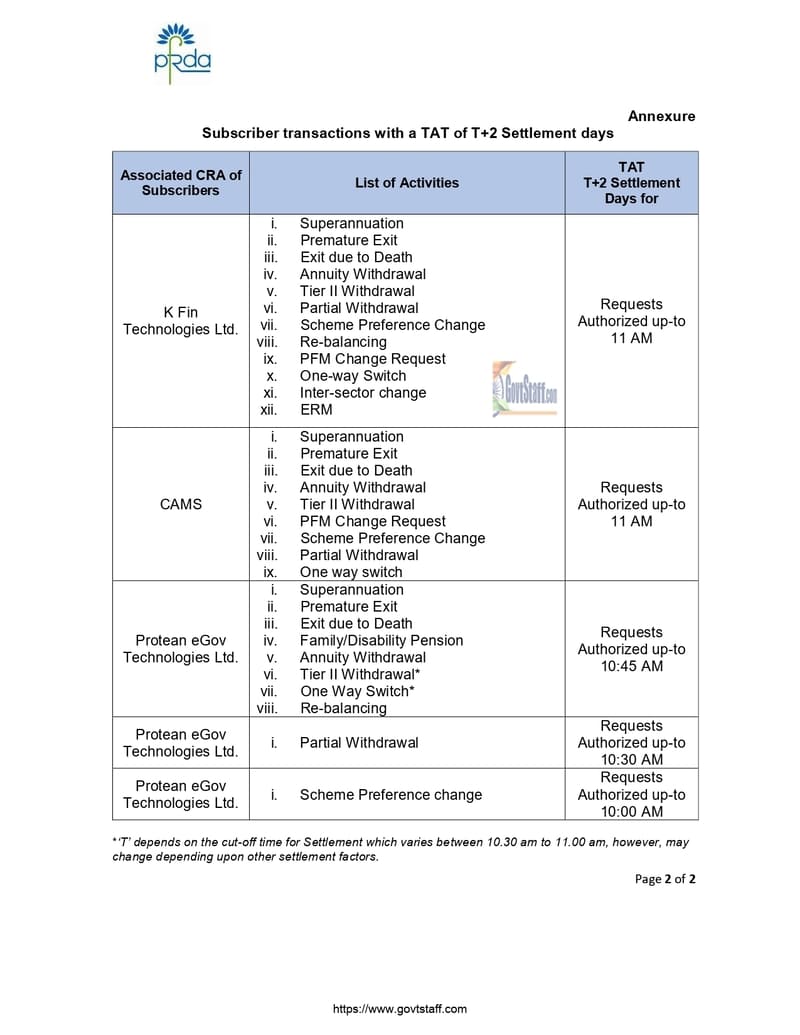

Minimum Timelines for Maximum Subscribers’ benefits – Reduction in Turn Around Time to perform various activities from T+4 to T+2 : PFRDA Circular

Minimum Timelines for Maximum Subscribers’ benefits - Reduction in Turn Around Time to perform various activities from T+4 to T+2 : PFRDA Circular

PE ...

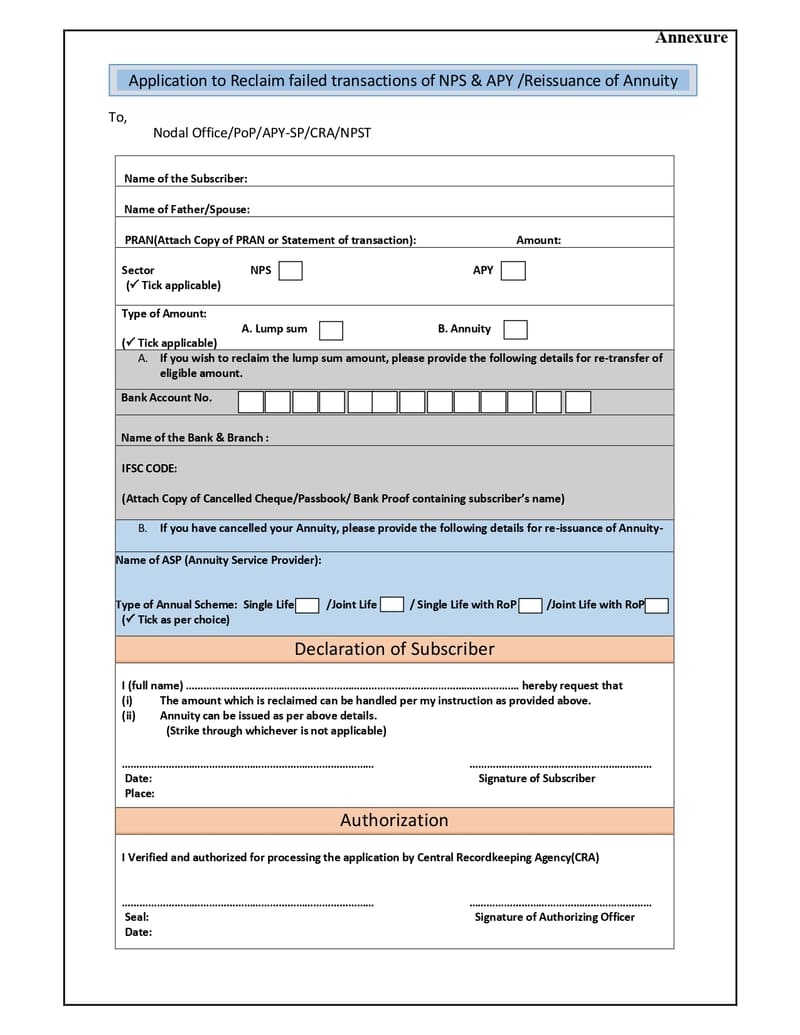

Reinvestment of Returned & Unsuccessful Transaction amount into the same PRAN – Ease of reclaiming the amount by Subscriber through My Withdrawal Module(MWM): PFRDA Circular

Reinvestment of Returned & Unsuccessful Transaction amount into the same PRAN – Ease of reclaiming the amount by Subscriber through My Withdrawal ...

Know Your Customer / Anti-Money Laundering / Combating the Financing of Terrorism (KYC/AML/CFT) – Guidelines issued by PFRDA vide circular dated 23.01.2023

Know Your Customer / Anti-Money Laundering / Combating the Financing of Terrorism (KYC/AML/CFT) - Guidelines issued by PFRDA vide circular dated 23.01 ...

Bank Account Verification & Name/PAN Matching using PAN-PRAN-VPA (UPI) using NPCI Framework – PFRDA Circular dated 12.01.2023

Bank Account Verification & Name/PAN Matching using PAN-PRAN-VPA (UPI) using NPCI Framework - PFRDA Circular dated 12.01.2023

PENSION FUND REGULA ...

Empowering APY Subscribers with ease of Aadhaar Seeding – Launch of Seeding Convenience through CRA Portal & Mobile App : PFRDA Circular

Empowering APY Subscribers with ease of Aadhaar Seeding – Launch of Seeding Convenience through CRA Portal & Mobile App : PFRDA Circular

...

Online Claim Processing by Intermediaries using Technology – Aadhaar & VCIP : PFRDA Circular dated 04-01-2023

Online Claim Processing by Intermediaries using Technology - Aadhaar & VCIP: PFRDA Circular dated 04-01-2023

पेंशन निधि विनियामक एवं विकास प्राधि ...

Partial Withdrawal for NPS Subscribers/ एनपीएस अभिदाताओं के लिए आंशिक प्रत्याहरण – PFRDA Circular dated 23.12.2022

Partial Withdrawal for NPS Subscribers/ एनपीएस अभिदाताओं के लिए आंशिक प्रत्याहरण - PFRDA Circular dated 23.12.2022

पेंशन निधि विनियामक एवं विकास प्र ...