Latest Posts

Policy regarding regularisation, confirmation and inactivation of Sportspersons recruited against Sports Quota: SECR Estt. Rule No. 66/2023

Policy regarding regularisation, confirmation and inactivation of Sportspersons recruited against Sports Quota: SECR Estt. Rule No. 66/2023

South Eas ...

Posting of contractual staff working on sensitive posts : CGA, FinMin OM dated 17.03.2023

Posting of contractual staff working on sensitive posts : CGA, FinMin OM dated 17.03.2023

MOST IMMEDIATE

No: M-59011/1/2019-CDN-CGA-Part(3)/2265

Go ...

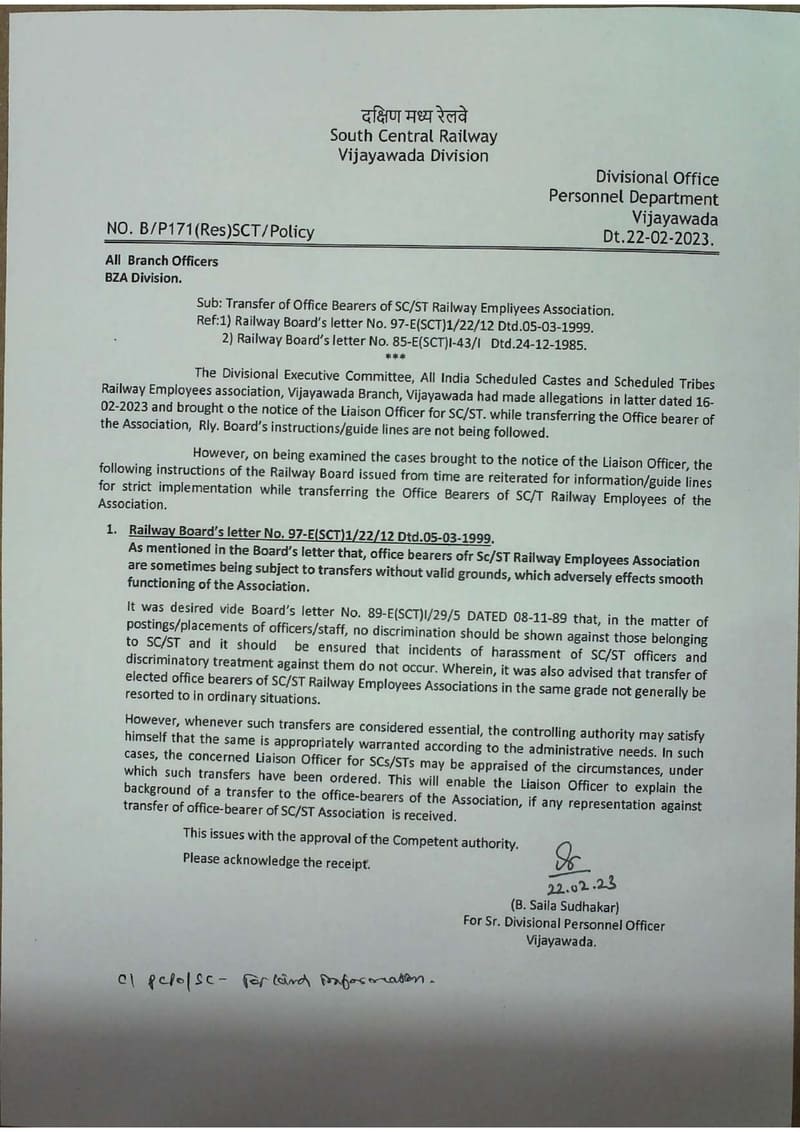

Transfer of Office Bearers of SC/ST Railway Employees Association – SC Railway order

Transfer of Office Bearers of SC/ST Railway Employees Association - SC Railway order

दक्षिण मध्य रेलवे

South Central Railway

Vijayawada Division

...

Empanelment of Health Care Organisation in Remote Areas not Holding QCI/NABH Certification – ECHS

Empanelment of Health Care Organisation in Remote Areas not Holding QCI/NABH Certification - ECHS

Central Organisation ECHS

Adjutant General’s Branc ...

Fresh Empanelment of HCOs from Bareilly, Agra & Lucknow from 06/03/2023 to 15/03/2025

Fresh Empanelment of HCOs from Bareilly, Agra & Lucknow from 06/03/2023 to 15/03/2025

No. 3-216/CGHS/LKO/2022/1731-48

Govt. Of India

Office of ...

Grant of Special Casual Leave to technical officials in sporting events: Railway Board Clarification/ Corrigendum vide RBE No. 33/2023

Grant of Special Casual Leave to technical officials in sporting events: Railway Board Clarification/ Corrigendum vide RBE No. 33/2023

RBE No 33/2023 ...

Reintroduction of Old Pension Scheme / पुरानी पेंशन योजना को पुन: आरंभ करना – OPS is not applicable to Central Government employees appointed after 31.12.2023

Reintroduction of Old Pension Scheme / पुरानी पेंशन योजना को पुन: आरंभ करना - OPS is not applicable to Central Government employees appointed after 31 ...

Vinayak Netralaya Indore depanelled from the panel of CGHS Indore – CGHS O.M. dated 13.03.2023

Vinayak Netralaya Indore depanelled from the panel of CGHS Indore - CGHS O.M. dated 13.03.2023

भारत सरकार Govt. of India

कार्यालय अतिरिक्त निदेशक O ...

Opening of new Kendriya Vidyalaya in the Deendayal Port Authority, Gandhidham, Gujarat under Project Sector

Opening of new Kendriya Vidyalaya in the Deendayal Port Authority, Gandhidham, Gujarat under Project Sector

केन्द्रीय विद्यालय संगठन

शिक्षा मंत्रालय ...

Linking of Unit government e-Mail ID with Unit code in Tulip application and dynamic website – CDA Guwahati Circular No. 31

Linking of Unit government e-Mail ID with Unit code in Tulip application and dynamic website - CDA Guwahati Circular No. 31

रक्षा लेखा नियंत्रक का का ...